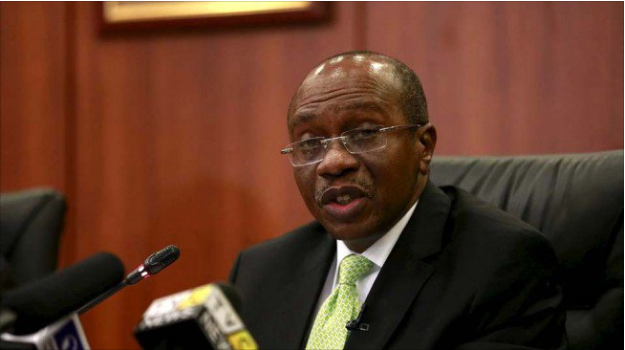

Today, Tuesday, January 24, 2023, investors, analysts, and other stakeholders will await the embattled Governor of the Central Bank of Nigeria (CBN), Mr. Godwin Emefiele, to address the media at approximately 2 p.m. to reveal the outcome of the Monetary Policy Committee (MPC) meeting.

The meeting, the first of the year, began on Monday.

Every two months, the apex bank gathers its team of economic and financial experts to examine the economy and then agree on the next monetary policy to implementing for economic growth.

The meeting’s main highlight is the Monetary Policy Rate (MPR), which is the benchmark interest rate. It determines the borrowing costs for businesses operating in Nigeria.

To further tame inflation, the MPC raised the MPR by 100 basis points to 16.5 percent from 15.5 percent at its most recent meeting in November 2022.

Though the CBN increased the rate at the previous MPC meeting, it was at a slower pace, and the team is expected to increase by less than 1% at this meeting.

The National Bureau of Statistics (NBS) reported last week that inflation in December 2022 fell to 21.34 percent from 21.47 percent due to a drop in food inflation to 23.75 percent in December 2022 from 24.13 percent in November 2022.

The MPC may be tempted to lower interest rates, but some analysts believe this is premature.

“I don’t see the CBN reducing the MPR tomorrow (today) just because of a drop in the inflation rate last month. It would be too soon to take such an action,” an economist based in Ibadan, Mr Sulaimon Akinpelu, told Business Post.

Furthermore, with inflation still above 20%, investors will be looking to the outcome of today’s meeting to guide them on the best investment instrument to put their funds into.

Their appetite for treasury bills may be waning as a result of the central bank’s recent reduction in the stop rate. On January 13, the rate settled at 7.30 percent, down from 8.49 percent the previous session.

Furthermore, Mr Emefiele’s briefing today will be significant because it will be the first time many will see him speak publicly after his return from a vacation abroad.

The Department of State Services (DSS) had attempted to apprehend him in order for him to answer allegations of terrorism financing. He was fortunate in that the courts prevented the secret police and other agencies from harassing or arresting him.

He reportedly visited President Muhammadu Buhari shortly after his return from abroad and informed him of the progress made in making the new Naira notes available to Nigerians, despite reports of a shortage in circulation.