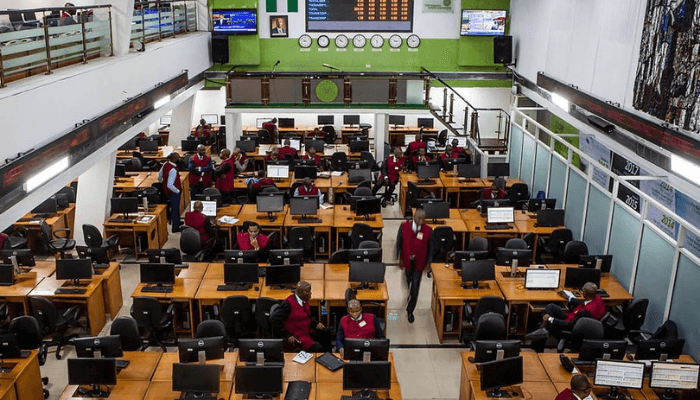

Nigerian stock market indices rose 0.61 percent on Thursday, boosted by bargain-hunting across the exchange’s major sectors.

It was observed that investors diverted their attention away from political risks and quickly purchased shares trading at lower prices.

As a result, the Nigerian Exchange (NGX) Limited’s All-Share Index (ASI) increased by 330.85 points to 54,646.38 points from 54,315.53 points, while market capitalisation increased by N180 billion to N29.769 trillion from N29.589 trillion.

According to EntrepreneurNG, the consumer goods sector outperformed the others yesterday, closing 3.79 percent higher due to interest in BUA Foods and Nigerian Breweries.

The insurance index increased by 0.40 percent, the banking and energy indices increased by 0.39 percent each, and the industrial goods sector increased by 0.06 percent.

The market breadth reflected the mood of investors during the session, finishing in the positive zone after 28 price gainers and 10 price losers, indicating very strong investor sentiment.

MRS Oil was the best-performing equity, rising 9.88% to N27.80, while McNichols increased by 9.09% to 60 Kobo, BUA Foods increased by 8.87% to N81.00, Cornerstone Insurance increased by 8.33% to 65 Kobo, and Transcorp Hotels increased by 7.44% to N6.50.

On the other hand, The Initiates was the worst-performing stock on Thursday, falling 9.09 percent to trade at 40 Kobo. Neimeth fell 6.45 percent to N1.45, Consolidated Hallmark Insurance fell 6.15 percent to 61 Kobo, Veritas Kapital fell 4.76 percent to 20 Kobo, and AIICO Insurance fell 1.67 percent to 59 Kobo.

Yesterday, 142.0 million stocks worth N1.9 billion were traded in 2,651 deals, up from 129.9 million stocks worth N3.9 billion traded in 2,678 deals the day before, representing a 9.32 percent increase in trading volume, a 51.28 percent decrease in trading value, and a 1.01 percent decrease in the number of deals.

UBA was the most active stock on the day, selling 32.4 million units. Courteville sold 16.0 million units, Zenith Bank sold 11.5 million units, GTCO sold 8.6 million units, and Chams sold 6.7 million units.