In a recent directive, the Federal Government of Nigeria has instructed commercial banks to deduct and remit 0.375% on all loans they disbursed.

According to notifications sent to customers by banks, this deduction will apply to the principal loan amount. This move signifies an expansion of the scope of transactions subject to stamp duty charges, extending from regular bank transfers to now include foreign transactions and loans.

Earlier directives mandated banks to deduct stamp duty on old foreign transactions between January 2021 and December 2023 by January 31, 2024. Before this, the electronic money transfer levy applied solely to accounts receiving electronic deposits of N10,000 and above or its equivalent.

Banks have already begun informing their customers about the upcoming deductions. In one such message, a bank notified its customers:

“Dear Valued Customer, “We write to inform you that the Federal Government of Nigeria has directed that all banks remit stamp duty on all loans. “In line with this directive, 0.375% on every principal loan amount disbursed will be debited and remitted to the Federal Government of Nigeria. “However, all approved loans remain unchanged and are to be fully repaid per the terms and conditions. We are committed to offering you exceptional service every step of the way.”

Key Points to Note:

- Stamp Duty is an indirect tax governed by the Stamp Duties Act. It applies to documents marked with a stamp or seal, making them legal and admissible in court.

- Former CBN Governor Godwin Emefiele disclosed that stamp duty revenue collected on behalf of the Federal Government totalled N370.686 billion between 2016 and 2022.

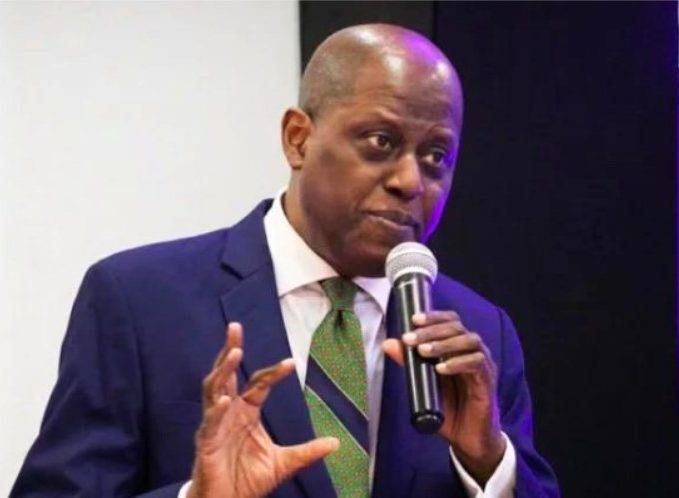

- The current Minister of Finance, Mr. Wale Edun, expects non-oil revenues from revenue-generating agencies to surpass the N13 trillion recorded in 2023, by the end of 2024, following measures to boost revenue collection.