Financial experts are voicing concerns over the Central Bank of Nigeria’s (CBN) recent decision to implement a hawkish monetary policy stance, resulting in a significant 22.75% increase in the interest rate. This move has sparked fears among experts regarding the potential repercussions, particularly regarding non-performing loans (NPLs) and financial stability.

Unprecedented Monetary Policy Measures

The CBN’s latest policy action saw a substantial increase in the monetary policy rate (MPR) by 400 basis points to a historic high of 22.75%. Additionally, adjustments were made to other key policy instruments, including the Cash Reserve Ratio and the Asymmetric Corridor.

Expert Perspectives

Mr. Mike Eze, Managing Director of Crane Securities Limited, acknowledges potential short-term benefits for the banking sector due to higher interest rates. However, he warns of looming challenges as businesses may struggle to meet loan obligations, leading to a surge in NPLs.

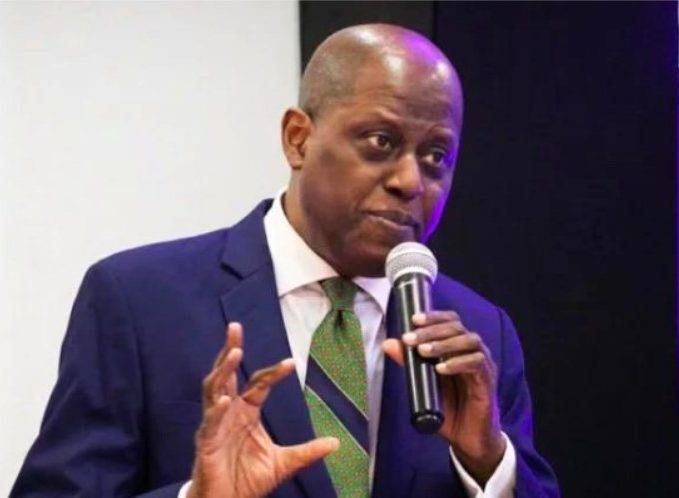

Professor Uche Uwaleke, Director of the Institute of Capital Market Studies, Nasarawa State University Keffi, criticizes the drastic MPR hike, expressing concerns about its impact on the real sectors of the economy. He predicts adverse effects such as limited credit access, increased capital costs, and strained financial stability indicators.

Mr. Olatunde Amolegbe, Managing Director of Arthur Steven Asset Management Limited, highlights the intent behind the MPR increase to curb inflation. However, he anticipates potential risks, including higher corporate borrowing costs and shifting investor focus from equities to fixed-income markets.

Anticipated Economic Consequences

Experts warn that the CBN’s stringent monetary policy measures may inadvertently lead to economic contraction, manifested through lower GDP figures, particularly in vital sectors like agriculture and industry. The tightening monetary stance could also trigger a notable price correction in the equities market as investors seek refuge in fixed-income securities.

While the CBN’s measures aim to address inflationary pressures, experts emphasize caution, highlighting potential adverse effects on loan defaults, NPLs, and overall economic stability.