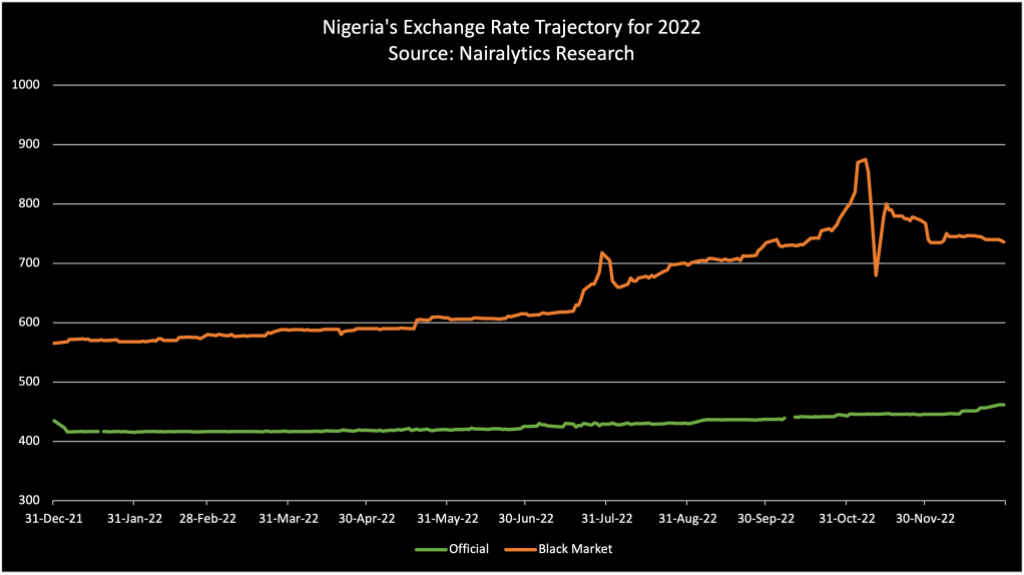

On the official Investor and Exporter window, Nigeria’s exchange rate closed the year 2022 at an official rate of N461.5/$1. This represents a 5.7% drop in one year.

The official Investors and Exporters (I&E) window exchange rate between the naira and the US dollar closed at N422.67/$1 on the first working day of 2022, after closing at N435/$1 in 2021.

However, on the black market, where rates are determined by a variety of market forces, the exchange rate closed between N730-N735 to the dollar on both peer-to-peer and cash trades. Inflows of dollars sold as transfers from overseas proceeds fetch an average of N740/$1.

This represents a 23.1% depreciation on the black market for the fiscal year ending December 31st, 2022. The black marker debuted in 2022 at a rate of N565/$1.

The difference in exchange rates between the official and black market rates is estimated to be N274.5/$1. At the start of the year, it was N130/$1.

Whirlwind 2022 for Exchange rate

The naira suffered a tumultuous 2022 as several policy decisions by the central bank triggered massive depreciation of the exchange rate in the second half of 2022.

- For example, in February 2022, the central launched the RT 200 scheme to drive export proceeds into the official channels. However, this failed to merge the official and black market rates.

- The central bank also maintained multiple exchange rate windows despite adamantly yielding to World Bank’s demand for a single exchange rate window.

- The CBN, however, settled for the NAFEX as the official benchmark for determining the exchange rate.

- CBN’s introduction of new naira notes was perhaps the biggest trigger for currency devaluation, sending the exchange rate tailspin against the US dollar.

Apart from the CBN policy actions, other factors that have affected the depreciation of the naira include higher interest rates globally and a drastic reduction in foreign investors’ portfolio inflows into Nigeria.

Others include a drop in Nigeria’s crude oil production for the better part of 2022 and a surge in demand for forex by companies looking to repatriate funds trapped in the country since the Covid-19 lockdown.

The dollar also gained against several global currencies as a hike in interest rates by the global central bank triggered a flight to safety to the dollar.

How the exchange rate performed throughout the year

First Quater: Global headwinds emanating from the Russia-Ukraine crisis saw the exchange rate depreciate to as low as N587/$1 by the end of March 2022.

- Meanwhile, on the official NAFEX market, the exchange rate was trading for N416.17/$1

- While most expected the central bank to cave in under pressure to devalue the currency it set up in RT 200 policy in February.

Second Quarter: According to our records, the exchange rate breached the N600/$1 price range on May 19 2022, closing at N603/$1.

- It will close the first half of the year at N615/$1. Traders who spoke to Naijaonpoint at the time alluded to this due to surging demand for forex amidst scarcity.

- The official rate was N429/$1.

Third quarter: Things got worse in the third quarter of the year as the exchange rate fell further, breaching the N700/$1 price in about 60 days.

- By the last day of August, the exchange rate was already trading at N700/$1 in most markets and even higher for inflows.

- By September 2022, the exchange rate was trading at N735/$1.

- Meanwhile, the official exchange rate traded at N437.05 depreciates past the price it opened last year.

Fourth Quarter: The exchange rate started the quarter with a massive slide triggered by central bank decisions to introduce new naira notes.

- The exchange rate fell to as high as N875/$1 in early November as traders scrambled for price discovery. Inflow prices for some traders sold for over N900/$1.

- While this was raging, the exchange rate at the official marker fell slightly to about N446/$1.

- As speculations for the forex wanned, the exchange rate at the black market strengthened, closing the quarter where it ended at about N735/$1.

The external reserve opened the year at $40.5 billion and closed 2022 at about $37 billion. This represents a sharp fall of about $3 billion in net sales.