In a recent development, banks have received a directive from the Nigeria Inter-Bank Settlement System (NIBSS) to remove non-deposit taking financial institutions from their transfer lists.

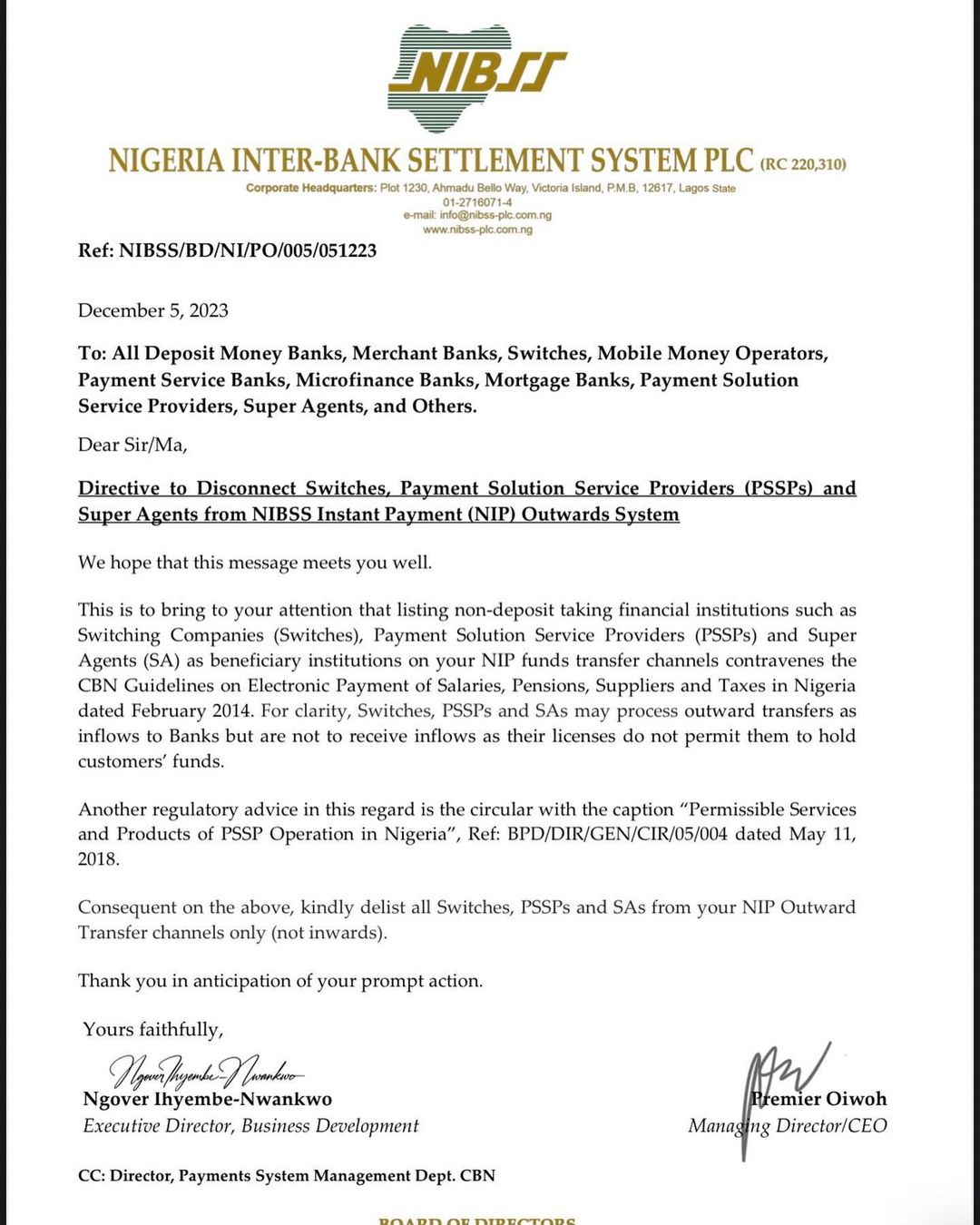

According to a circular signed by Ngover Ihyembe-Nwankwo, the Executive Director of Business Development at NIBSS, non-deposit taking financial institutions are now only permitted to process money, not hold it. This directive extends to Deposit Money Banks, Merchant Banks, Switches, Mobile money operators, and others.

The circular emphasizes that listing non-deposit-taking financial institutions, including switches, payment solution service providers (PSSPs), and super agents, on funds transfer channels violates the Central Bank of Nigeria (CBN) guidelines on electronic payment.

While these institutions can process outward transfers as inflows to banks, they are prohibited from receiving inflows, as their licenses do not authorize them to hold customers’ funds. NIBSS urges banks to delist switches, PSSPs, and super agents from their NIP outward transfer channels.

Despite rumors, sources clarify that the directive is not targeted specifically at Fintechs but is a regulatory measure to prevent license abuse. The move is seen as an effort to sanitize the sector, aligning with the CBN governor’s earlier hints at the need for such measures during the CIBN dinner.

Noteworthy entities such as flutterwave, Venture Gardens, Interswitch, and others may be impacted by these changes.

During the 58th Annual Bankers Dinner and Grand Finale of the 60th anniversary of the Chartered Institute of Bankers of Nigeria (CIBN), CBN governor, Yemi Cardoso, expressed concerns about recent developments in the payment services landscape. He highlighted the misuse of technology and existing licensing and regulatory frameworks.

Governor Cardoso warned against intentional or unintended non-compliance, emphasizing that operators must ensure they are licensed for the activities they undertake. He announced the apex bank’s intention to conduct a comprehensive review of the licensing framework for payment services, engaging in extensive consultations to develop a new regulatory and compliance framework suitable for the technology-driven payment services sector.