In Nigeria, there are lots of fintech apps that help people save and invest money, with PiggyVest standing out as one of the notable options. Positioned as a popular fintech app, PiggyVest simplifies the process of saving and investing for users through its user-friendly interface. Noteworthy features include automated savings, fixed savings plans, and diverse investment opportunities.

PiggyVest has been active in Nigeria for over seven years and is operating with the approval of the Central Bank of Nigeria (CBN). This means that PiggyVest has met the regulatory requirements set by the CBN, allowing it to legally carry out its financial services in Nigeria.

Recognised as an authorised fintech entity, PiggyVest’s approval by the CBN underscores its compliance with the necessary regulations and also instills confidence in its users.

Features of PiggyVest

-

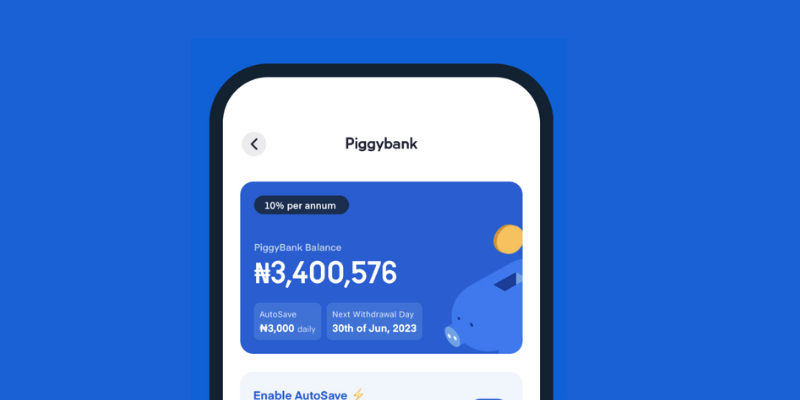

PiggyBank: PiggyBank, a feature offered by PiggyVest, streamlines the savings process. Users can automate deposits of any chosen amount on a daily, weekly, or monthly basis. You can earn up to 10% interest per year on your savings. It’s a fantastic option if you want to build up your savings or explore the functionality of PiggyVest.

-

Safelock: Safelock serves as a structured savings solution within PiggyVest, offering users an opportunity to earn up to 12.5% annual interest, with the unique feature of upfront interest payment. By committing funds for a minimum of ten days, users can tailor their returns based on the duration of the lock.

-

Target Savings: Target Savings allows users define and pursue specific financial goals, individually or collaboratively. With an annual interest rate of 9%, this feature aids consistent progress toward set objectives.

-

Flex Naira: Flex Naira operates as a savings wallet, facilitating the accumulation of interest from other wallets. You have access to free transfers and withdrawals. Users can earn up to 8% annual interest, contingent on limiting withdrawals to no more than four times a month.

-

Flex Dollar: Flex Dollar allows users save in dollars, providing a means to safeguard the value of their savings. With an uncomplicated setup process, users can earn up to 7% interest annually.

-

Investify: Investify allows users invest in pre-vetted, low-to-medium risk opportunities. Users can explore various investment options with varying minimum investment requirements.

How to create a PiggyVest account

To create an account, follow these steps:

-

Visit the PiggyVest website or download the official app, which is available for free on the App Store and Google Play Store.

-

Locate and click on the “Create free account” button; if you’re using the app, you might find it labeled as “Register.”

-

Provide the necessary details as prompted, and click on “Create Account.” Make sure to review your information before submitting to avoid any issues with your newly created PiggyVest account.

-

Set up your withdrawal bank. This account must be in your name, as PiggyVest will use it to send your money whenever you decide to make a withdrawal.

-

Verify the details you’ve provided and activate your account. This process typically takes just a few seconds.

-

Choose your preferred savings and investment option from the available plans on PiggyVest. For more information about the various plans, you can refer to the previous section of this article.

Without a doubt, PiggyVest is a legitimate platform. With its user-friendly interface, diverse features, and a track record of providing secure services for over seven years, PiggyVest stands as a reputable fintech platform.