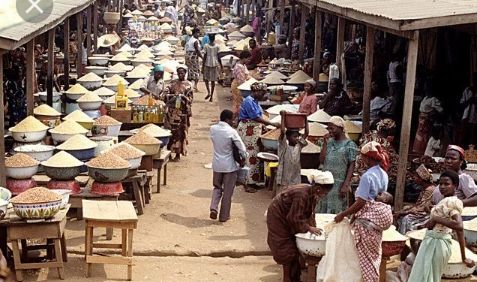

As the panting of this cashless policy continues in Nigeria so many business owners are becoming more frustrated on daily basis, Entrepreneurng report.

There has been a great record of reduced sales and decreased production of perishable goods. Most prices of goods and services have drastically been inflated overnight.

As this problem continues to linger around so many business owners are confused and are looking for a way of surviving this problem of the cashless policy In Nigeria today.

The fact is that most local business owners don’t have a bank account and that has been a great hindrance for many of them to embrace e-mobile transactions, while others have a bank account but probably not functioning well.

As most of the banks now are having both internal and external crises, this is not the time to open an account with any of these banks because even banks like zenith bank, access bank, and some others have shut down.

There are a lot of trusted and tested online banking platforms such as Kuda bank, OPAY bank, Kudi bank, Standard Charted Bank, Palmpay bank and so many others. These are online banking one can easily open either on your iPhone or Android phone.

The only way some business owners are surviving is because they have access to a bank account that their customers can easily transfer to them after purchasing a good or service.

The search for cash continues to get worsen on daily basis truth be told and so many people are denied access to the new naira notes. So the only option left for most people patronizing your business is to do an e-transaction.

Most business owners are scared of adopting this method because some might do a fake transaction claiming it as original. The best thing to do now is to acquire knowledge of how to check your account balance either through your bank app or your USSD code before releasing your good or rendering your service to your customer.

To avoid the scenario of being involved with a fraudster, avoid selling your goods at least for now to strangers or when you notice suspicious activity from the person.

Online banking as mentioned above is very fast and reliable and has been a lifesaver at a time like this, if not for my online banking that l have been using l tell you things might be more difficult because most Nigerian banks still working are falling short of network service.

In conclusion, now that l have exposed you to online banking. The next thing to do Is to seek information from either this online banking agent that is seen around or you can easily google it on your browsing phone. For example, how to open an OPAY account.

When this is all set, it is time to change along with the current situation and embrace e-banking and make great sales and profits even in a season of cashless policy.