Foreign portfolio investment (FPI) outflows surged by 237% in the first quarter (Q1) of 2024 compared to the same period in 2023, according to data from the NGX research department. Outflows reached N119.81 billion in Q1 2024, a significant increase from N35.59 billion in Q1 2023.

Despite the surge in outflows, the total foreign inflow for Q1 2024 also saw a dramatic increase, exceeding N93.37 billion compared to N18.12 billion in Q1 2023. This disparity highlights the heightened market reactions to the Central Bank of Nigeria (CBN) reforms.

The data showed that the Nigerian equity market experienced a significant gap between foreign portfolio inflows and outflows, raising concerns over investor confidence and market stability. The total net outflow for the quarter was N26.44 billion, indicating that foreign investors withdrew more funds than they invested.

Monthly Breakdown

January 2024: Foreign outflows were N37.33 billion, more than doubling the inflows of N15.78 billion. January 2023 saw inflows of N9.84 billion and outflows of N15.06 billion, representing a 60.3% increase in inflows and a 147.8% increase in outflows year-over-year. January 2024 ended with a net outflow of N21.55 billion.

February 2024: Foreign inflows were N24.93 billion, while outflows amounted to N40.88 billion. In February 2023, inflows were N3.68 billion and outflows were N15.94 billion, marking a 577.7% increase in inflows and a 156.4% increase in outflows. The net outflow for February 2024 was N15.95 billion.

March 2024: The highest inflow of the quarter was recorded at N52.66 billion, with outflows at N41.60 billion. March 2023 saw inflows of N4.60 billion and outflows of N4.59 billion, indicating a remarkable 1044.8% increase in inflows and an 806.3% increase in outflows. March 2024 was the only month with a positive net inflow of N11.06 billion.

Implications of Higher Outflows

The significant rise in foreign portfolio outflows amid CBN reforms suggests a lack of confidence among foreign investors in the Nigerian market, potentially due to uncertainties around the reforms and perceived risks. This trend can pressure the Nigerian naira, possibly leading to depreciation as foreign investors convert their holdings to foreign currencies.

Higher outflows can also reduce liquidity in the Nigerian financial markets, increase borrowing costs, and potentially stifle economic growth. Additionally, increased outflows can lead to declining stock prices as foreign investors sell their holdings, reducing local investors’ market capitalization and investment returns.

If the outflows are substantial, they could signal broader economic issues, impacting overall economic growth and reducing capital available for businesses.

CBN’s Perspective

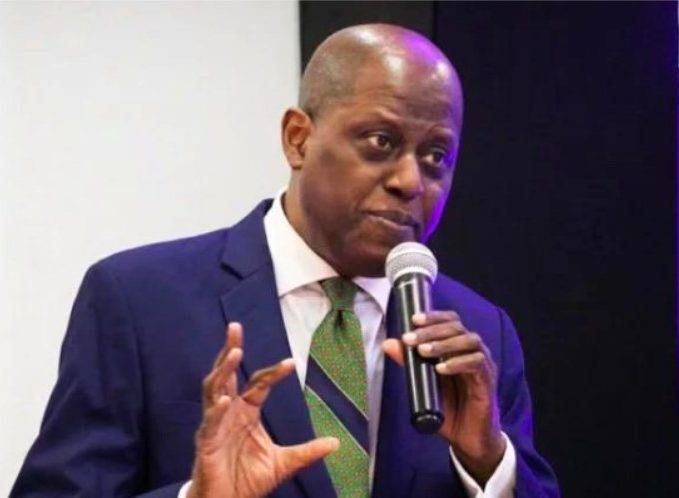

CBN Governor Yemi Cardoso, speaking at the end of the 294th meeting of the Monetary Policy Committee (MPC), stated that it is normal for investors to enter and exit the market. He emphasized the importance of understanding investor needs and implementing reforms to ensure market transparency.

Cardoso highlighted the prioritization of clearing the forex backlog to boost investor confidence and noted improved ratings from agencies like Fitch as a positive sign for the Nigerian market.

What You Should Know

Victor Onyema, Lead Portfolio Management at Norrenberger Asset Management, mentioned that recent CBN efforts to restore market confidence and enhance communication with investors are encouraging. This proactive approach is expected to renew interest among Foreign Portfolio Investors (FPIs) in the Nigerian market.

The significant rise in FPI outflows during Q1 2024 reflects investor responses to ongoing CBN reforms. While these reforms are reshaping market dynamics, the increase in outflows underscores the need for strategies to boost investor confidence and attract more stable foreign investments.