The Central Bank of Nigeria’s (CBN) recent guidelines on International Money Transfer Operators (IMTO) operations have cast doubt on the standing of leading fintechs like Flutterwave, Interswitch, and Paga. The guidelines restrict banks and fintechs from engaging in international money transfer services.

While the directive doesn’t grant IMTO licenses to banks, it leaves a grey area regarding the fate of already licensed fintechs, including notable names like Flutterwave, Interswitch, Paga, Xpress Payment Solutions, and Paycom.

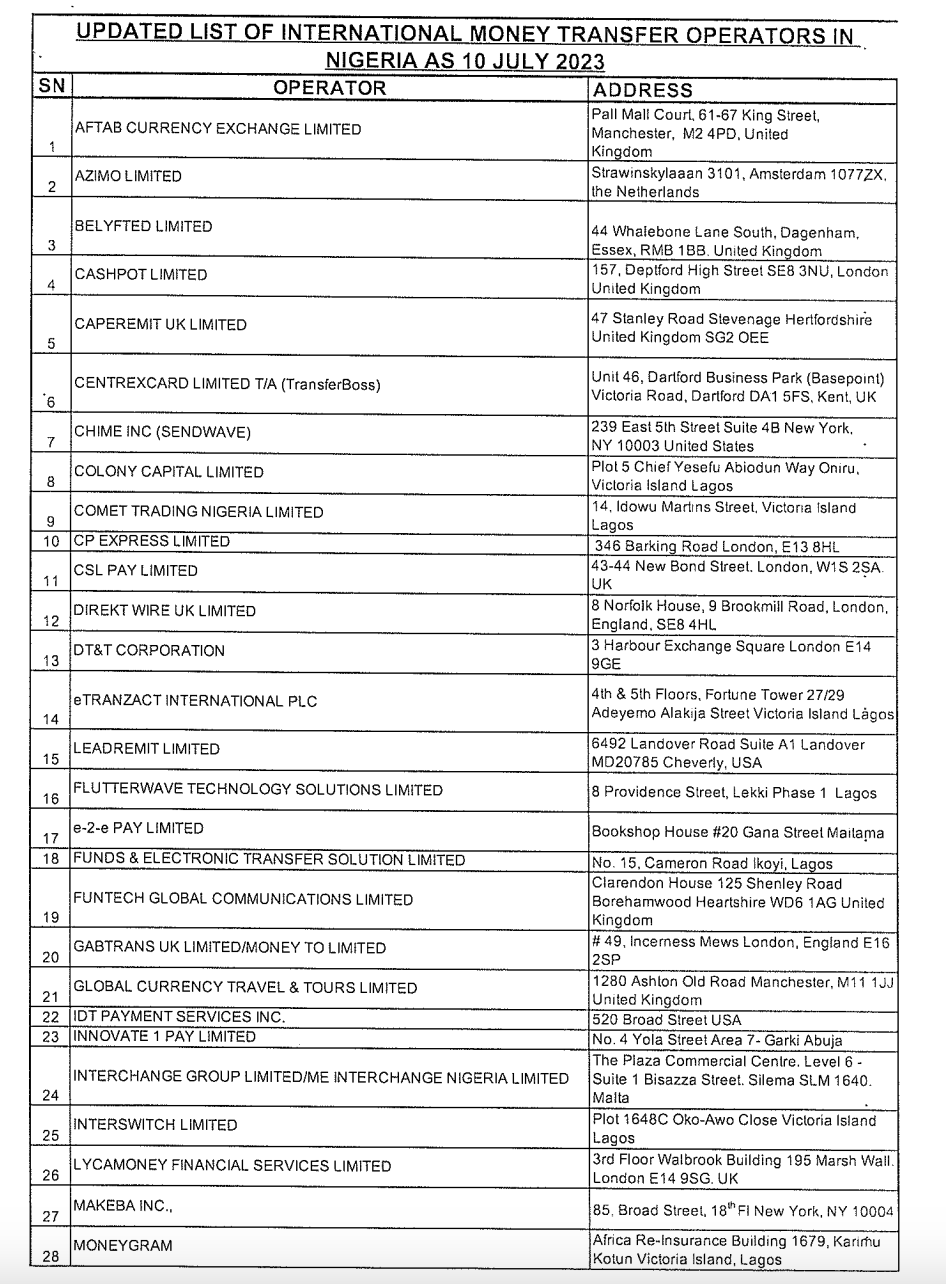

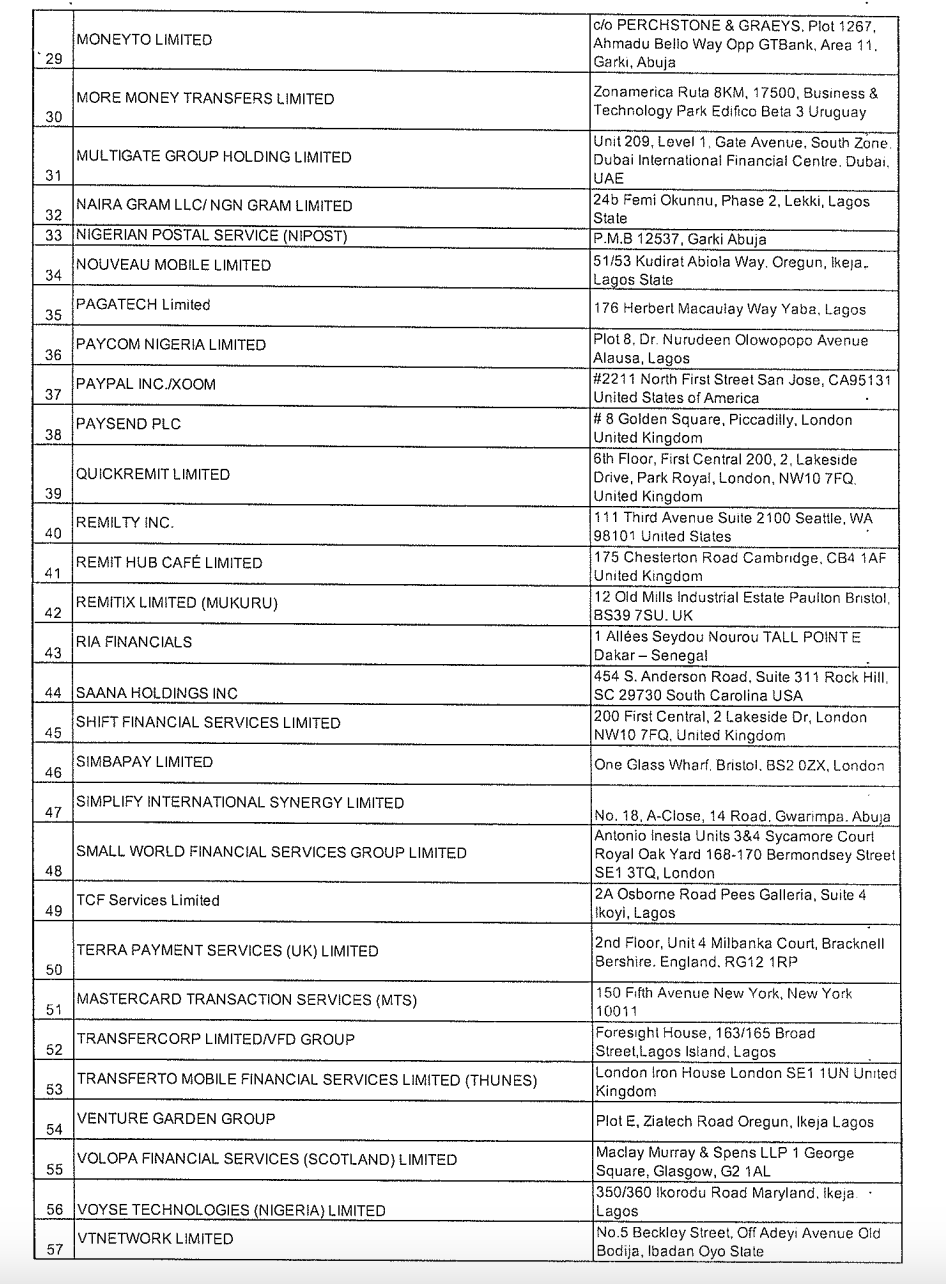

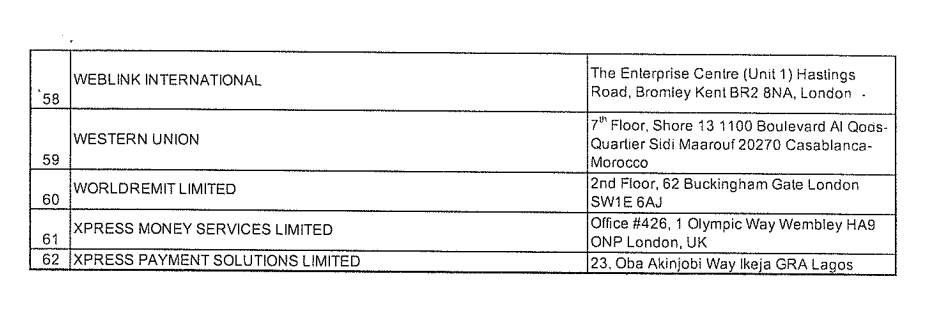

The CBN’s official database reveals 62 companies in Nigeria, including foreign fintechs, holding IMTO licenses.

Key Points from CBN’s Guidelines

In the revised guidelines released on January 31, 2024, the CBN outlined significant changes:

- Prohibition on Banks: All banks are barred from operating International Money Transfer services but can function as agents.

- Restriction on FinTechs: Financial Technology Companies are not permitted to seek approval for IMTO licenses, indicating a potential halt to new licenses for FinTechs.

- License Ambiguity: While fintechs might be restricted from new applications, the guidelines do not explicitly state the status of existing fintechs with IMTO licenses.

- License Fee Surge: The application fee for an IMTO license has skyrocketed from N500,000 in 2014 to N10 million, marking a substantial increase of approximately 1,900% over a decade.

- Capital Requirements: The CBN introduced a minimum operating capital requirement of $1 million for foreign IMTOs and an equivalent amount for local operators, replacing the previous thresholds.

Uncertainty for Fintechs

The lack of clarity surrounding the status of fintechs already licensed as IMTOs has created uncertainty within the industry. While the guidelines suggest a freeze on new licenses for fintechs, it remains unclear whether existing licensees can continue their operations unhindered.

IMTO Landscape in Nigeria

IMTOs are crucial in facilitating fund transfers from individuals or entities abroad to recipients in Nigeria. As of July 2023, the CBN had licensed 62 companies to operate as IMTOs.

The full list of licensed IMTOs, encompassing a mix of local and foreign entities, can be found on the CBN’s database.

As the financial landscape undergoes significant changes, industry players, especially fintechs, await further clarification from the CBN to navigate the evolving regulatory landscape.

See List below: