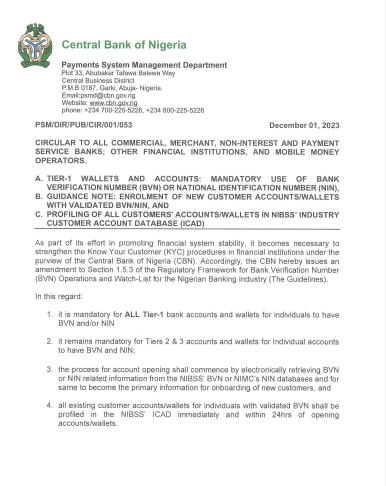

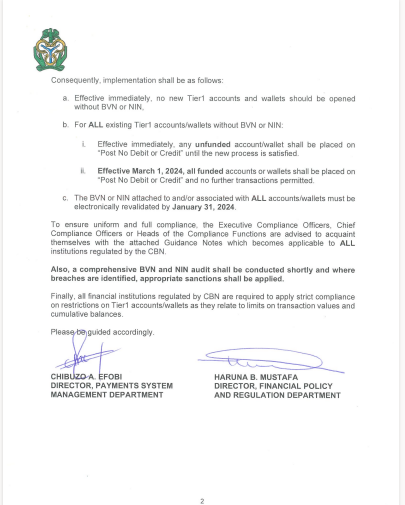

In a significant development, the Central Bank has declared that as of April 2024, all bank accounts lacking BVN and NIN will be tagged with “Post no Debit” (PND).

This crucial information surfaced in a circular released by the apex bank on December 1, 2023, addressed to all deposit money banks nationwide.

To ensure compliance, the Central Bank emphasized that all BVN or NIN linked to accounts or wallets must undergo electronic revalidation by January 31, 2024.

This initiative, according to the CBN, aligns with their commitment to bolstering financial stability within the country, enforcing section 1.5.3. of the Regulatory Framework of Bank Verification Number (BVN) and Watch-List for the Nigeria Banking Industry.

Implications for Account Holders

In light of this, the CBN outlined the following mandates:

- Individuals holding Tier-1 bank accounts and wallets must possess NIN and/or BVN.

- Mandatory NIN and BVN requirements extend to Tier-2 and Tier-3 individual accounts and wallets.

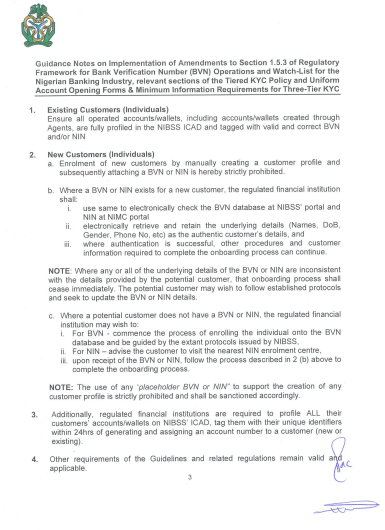

- The account opening process will commence by electronically retrieving BVN and NIN information from their respective databases.

- Existing customer accounts and wallets with validated BVN will be swiftly profiled in the NIBSS’ ICAD within 24 hours of opening.

Important Considerations

The CBN warns that failure to adhere to these guidelines will result in account holders facing a “Post no Debit or Credit” status until compliance is met.

Additionally, all BVN and NIN registrations linked to accounts and wallets must undergo revalidation before January 1, 2024.

Lastly, financial institutions under the apex bank must strictly follow the new guidelines concerning transaction value limits and cumulative balances.

For more details, refer to the attached document below: