The Central Bank of Nigeria (CBN) has issued a directive mandating Microfinance banks, Primary Mortgage Banks (PMBs), and Development Financial Institutions (DFIs) to submit their financial returns monthly through the FinA application or face potential sanctions.

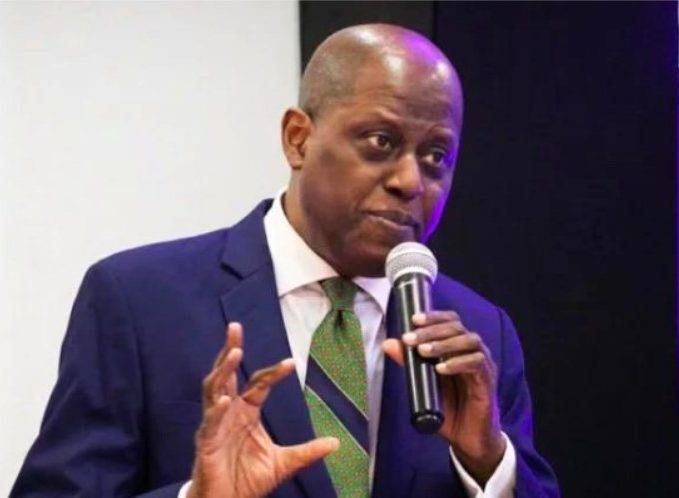

In letters signed by Dr. Valentine Ururuka, the Director of the Financial Policy and Regulatory Department, the CBN emphasized the importance of timely submission of financial returns. Failure to comply may result in sanctions, as outlined in relevant banking regulations.

Microfinance Banks (MFBs)

Microfinance banks were reminded of the provisions of the Banks and Other Financial Institutions Act (BOFIA), 2020, and other regulations regarding the timely submission of regulatory returns. The CBN instructed MFBs to ensure that their monthly FinA returns are submitted by the 5th day after the end of each month. In cases where the 5th day falls on a weekend or public holiday, returns should be submitted on the previous workday.

Primary Mortgage Banks (PMBs) and DFIs

Similar directives were issued to Primary Mortgage Banks and Development Finance Institutions, emphasizing the importance of adhering to regulatory requirements. PMBs were instructed to submit their monthly FinA returns by the 5th day after the month’s end, with the same provision for weekends or public holidays.

The CBN underscored the significance of timely rendition of regulatory returns, warning of potential sanctions for future breaches. All financial institutions under the specified categories were strongly advised to ensure compliance with regulatory obligations to avoid penalties.