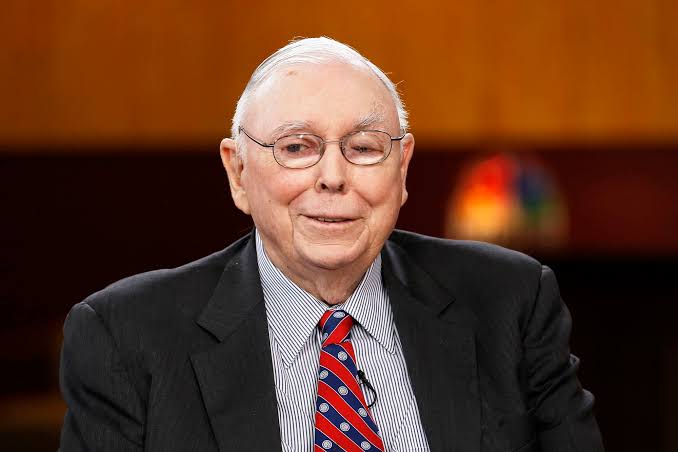

Charlie Munger, a billionaire and astute investor who amassed wealth prior to being Warren Buffett’s trusted advisor at Berkshire Hathaway, passes away at the age of 99.

According to a Berkshire Hathaway news release, Munger passed away on Tuesday. The group said that family members informed them that Munger passed away quietly this morning at a hospital in California. On New Year’s Day, he would have turned 100.

“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation,” Buffett said in a statement.

Munger was not only the vice chairman of Berkshire, but also a real estate attorney, the chairman and publisher of the Daily Journal Corp., a board member of Costco, an architect, and a philanthropist.

His projected fortune in the beginning of 2023 was $2.3 billion, which many found astounding but far less than Buffett’s unbelievable fortune, which is estimated to be worth over $100 billion.

The 97-year-old Munger reportedly unintentionally disclosed a closely-kept secret during Berkshire’s 2021 annual shareholder meeting: Vice Chairman Greg Abel “will keep the culture” following the Buffett era.

Munger had lost his left eye due to complications following cataract surgery in 1980. He wore heavy spectacles.

From 1984 until 2011, when Buffett’s Berkshire acquired the last shares of the Pasadena, California-based insurance and investment company it did not own, Munger served as chairman and CEO of Wesco Financial.

Buffett said that Munger changed his focus from buying distressed companies at low prices in the hopes of making a profit to buying higher-quality yet inexpensive enterprises.

Munger’s ability to convince Buffett to approve Berkshire’s $25 million acquisition of See’s Candies in 1972, despite the California candy maker’s meagre $4 million in pretax revenues, served as an early example of the shift. Since then, Berkshire has generated sales of almost $2 billion.

“He weaned me away from the idea of buying very so-so companies at very cheap prices, knowing that there was some small profit in it, and looking for some really wonderful businesses that we could buy in fair prices,” Buffett told CNBC in May 2016.

Another way to say it is as Munger stated it at the Berkshire shareholder meeting in 1998: “It’s not that much fun to buy a business where you really hope this sucker liquidates before it goes broke.”

Munger frequently provided a straight face to Buffett’s lighthearted observations. He would respond, “I have nothing to add,” to one of Buffett’s rambling answers to queries at the Berkshire annual meetings in Omaha, Nebraska. Nonetheless, Munger was a wealth of knowledge in both life and finance, much like his friend and colleague. And Munger’s wisdom was not without humour, much like that of Benjamin Franklin, one of his heroes.

“I have a friend who says the first rule of fishing is to fish where the fish are. The second rule of fishing is to never forget the first rule. We’ve gotten good at fishing where the fish are,” the then-93-year-old Munger told the thousands of people at Berkshire’s 2017 meeting.

He was a proponent of the “lollapalooza effect,” which postulated that investment psychology was driven by a combination of circumstances.