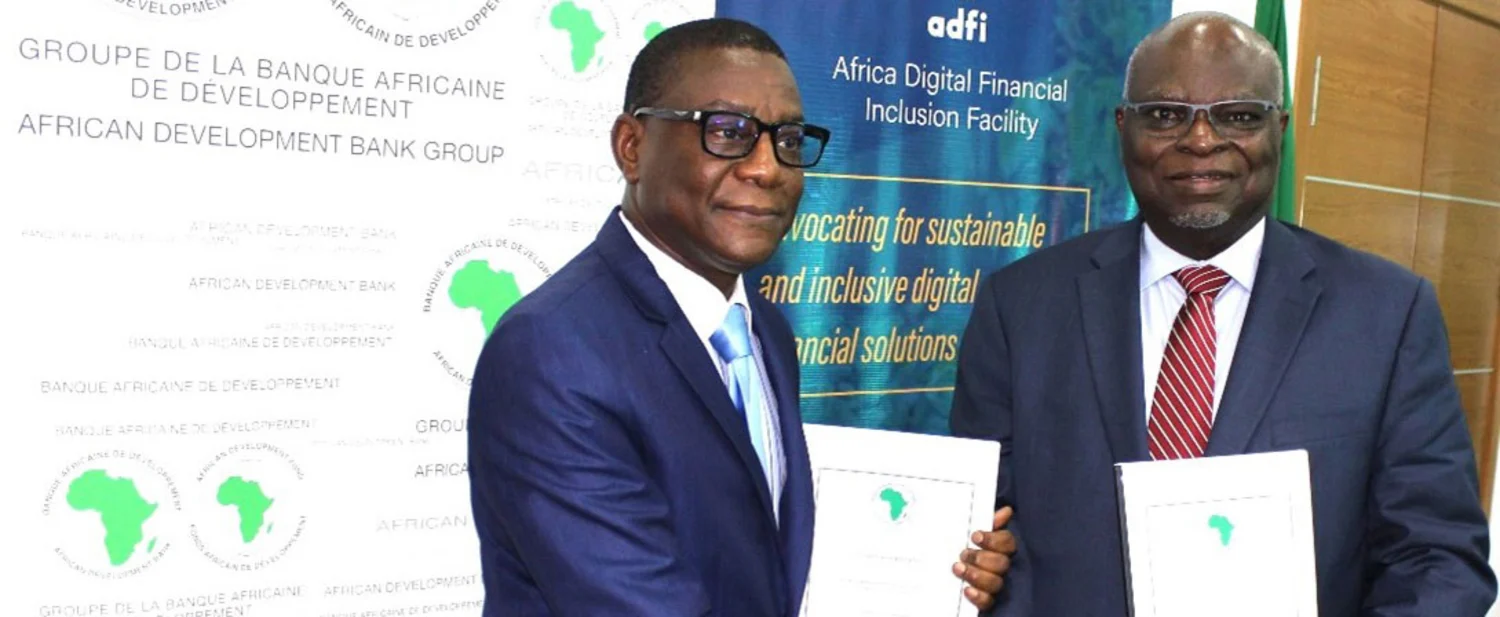

The African Development Bank (www.AfDB.org) has signed a $525,000 grant agreement with Africa Fintech Network (AFN) for the setup of the Africa Fintech Hub (www.AfricaFintechNetwork.com/), an online portal that will serve as a one-stop shop for all fintech activities in Africa.

The agreement was signed on 4 April 2023.

The Africa Digital Financial Inclusion Facility (ADFI) will provide funding and technical assistance to the Africa Fintech Network to host and manage the Africa Fintech Hub. The hub is a digital platform that will enable fintech associations across Africa to pool resources and knowledge, strengthen relationships and partnerships, as well as showcase the work of fintech on the continent, including those which are female-led or owned.

The African Fintech Hub will be delivered through a strategic partnership between AFN and the Centre for Financial Regulation and Inclusion (Cenfri), which will provide technical support in the development of the Hub, as well as promote research, knowledge creation, and other innovative initiatives.

Lamin Barrow, Director General of the African Development Bank‘s Nigeria Country Department, underscored the importance of the Bank’s support to the project, saying it would contribute to strengthening the fintech ecosystem in Africa, boost competitiveness in the digital world, whilst leveraging partnerships.

“At the African Development Bank, we recognize that we have a major role to play in helping to create a robust, efficient and sustainable fintech ecosystem across the continent. We are accelerating the delivery of our High 5 strategic priorities through our various innovative interventions. These have helped improve access to digital infrastructure, including Information and Communications Technology linkages to landlocked countries and broadband internet services. The need to leapfrog barriers and scale up inclusive digital financial solutions to accelerate economic resilience across Africa has become even more urgent.”

The African Development Bank, together with its partners, launched the Africa Digital Financial Inclusion Facility to make catalytic investments in support of innovative ideas such as the Africa Fintech Hub Project aimed at expanding access and usage of digital financial solutions to meet the needs of all Africans.

Dr. Segun Aina, President of Africa Fintech Network, commended the Bank for supporting the initiative.

“We are truly excited about this partnership with the African Development Bank, and the possibilities of working in partnership with Cenfri on multiple initiatives with fintech across Africa to further our mission to drive Africa-led fintech solutions, stimulate information exchange, ideation, and the support and to promote innovative technologies within the financial services sector across Africa and beyond. “

ADFI Coordinator, Sheila Okiro, said the Bank, through the partnership with the Africa Digital Financial Inclusion Facility, is delighted “to support this project to strengthen the fintech sector, furthering our work to leverage technology to contribute to closing the financial inclusion gap and creating employment across Africa.”

Currently, ADFI-supported projects are enhancing digital financial infrastructure and regional interoperability through the development of payment systems and infrastructure in Ethiopia and the ECOWAS region. Other projects are equipping financial sector regulators with innovative technology to strengthen consumer protection in Ghana, Rwanda, and Zambia.

The Facility is also supporting projects to enhance the deployment of digital micro-insurance to smallholder farmers in Nigeria, Zambia, and Kenya, as well as to build capacity for cyber resilience and help to remove barriers to access to fintech services across the continent.

Although fintech has great potential to contribute to digital financial inclusion across the continent, the African fintech sector significantly lags behind those in other regions such as Latin America and South-East Asia.

In 2019, AFN and Cenfri conducted a survey that demonstrated the need to establish and coordinate local fintech chapters, recruit new members, profile members’ achievements, link them to market access and investment opportunities, as well as advocate on behalf of members to local and regional regulators.

The survey also shows that less than 15% of fintechs are owned by women. Based on the result of the survey, AFN will develop and apply gender indicators and lenses as a core part of the project implementation.