Once upon a time, it was nearly impossible to obtain a loan in Nigeria without going through an agent or being a salaried employee. It was similarly impossible to open a retirement savings account or obtain a pension plan if you were not employed.

As recently as 2015, if you wanted to get a loan from a legitimate source, such as a bank, you would have had to fill out reams of paperwork and answer endless questions, with no guarantee you would get what you needed. However, times have changed, and companies such as Carbon are flipping this norm, making it easier and more efficient to obtain loans and other credit facilities.

At one point in Nigeria, the concept of owning a product, such as a smartphone or smart TV, without having to pay the full price for it was reserved for a select group of people. That is no longer true.

“In a country where only 2% of the 106 million adult population has access to bank credit, credit cards are conspicuously absent, as banks shy away from consumer lending,” according to this Rest of World report. BNPL [Buy Now, Pay Later] is becoming a popular alternative and is expected to expand further as Nigerians embrace digital credit.” This is a far cry from a few years ago, and Carbon is at the vanguard of this revolution.

Let’s take a step back to see where this is coming from. What was the standard? What were the difficulties that came with it? What exactly is the new reality? What are the opportunities that it brings? And what makes Carbon uniquely positioned to continue addressing these issues?

Historically, Nigerian banks have been risk-averse when it comes to lending to individuals rather than corporations. According to a 2017 report by the Central Bank of Nigeria, only 5.4% of Nigeria’s adult population had access to credit. In 2018, the figure increased slightly to 5.5%, and in 2019, it was 6.2%.

The central bank issued a directive in September 2019 raising banks’ Loan to Deposit Ratio to 65% in order to encourage more banks to lend to non-corporate customers. This directive required banks to lend out a certain percentage of their total deposits. This initiative aimed to boost the economy and increase cash flow. It also demonstrated how difficult it had become for the average Nigerian to obtain the credit required to improve their businesses and quality of life.

There is, of course, an opposite side to everything. Banks were not risk averse because they wanted to be. Instead, they were that way to protect themselves, and it was also a reflection of reality in some ways. Financial institutions require accurate data to assess an individual’s creditworthiness in order to properly issue loans. Many financial institutions were unable to harvest, process, and use the data required to make significant lending decisions due to underlying infrastructure issues and a lack of agility to innovate quickly.

Nature, on the other hand, always finds a way to fill these gaps. Whereas some legacy financial institutions were slow to act, younger and more agile innovators saw an opportunity to create solutions that could improve the lives of others and open more doors.

OneCredit, a consumer lending pioneer in Nigeria, opened its doors in June 2012. Its promise was straightforward: it would make it easier for wage earners to obtain loans at a time when lending money without collateral was impossible. However, OneCredit took the risk. In March 2016, the company rebranded as Paylater, a platform that offers instant loans digitally as well as payment and investment opportunities to its users. It was Nigeria’s first digital lender, yet another risk in an otherwise conservative industry. Paylater grew into Carbon in 2019, a credit-led pan-African digital bank that offers affordable loans, a deposit account, a high-yield savings account, free bill payments, free transfers, and debit cards.

By December 2021, the company’s revenue was N7.72 billion, with a gross profit of more than N5.6 billion. Its revenue had surpassed N3.9 billion by mid-2022, with a gross profit of more than N2.65 billion. It now has more than 3 million customers.

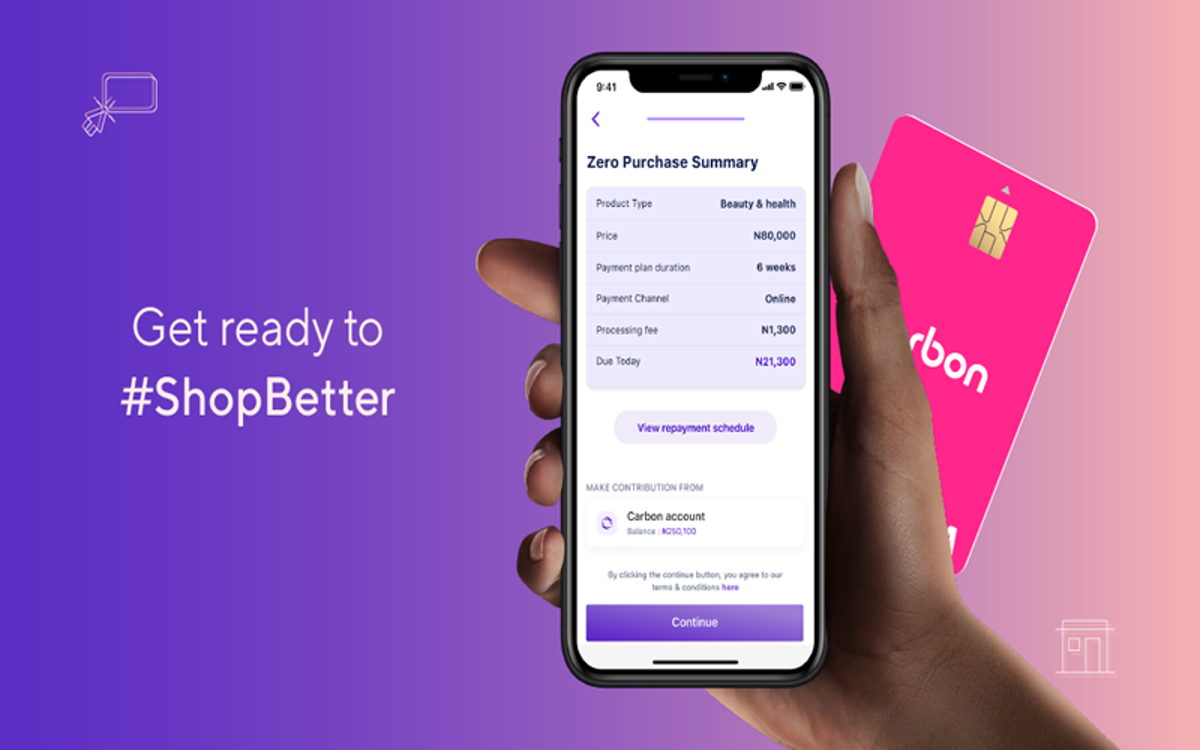

The company launched Carbon Zero in January 2021, allowing users to buy items they want and pay in 3-6 instalments with no interest added. This is especially useful given that Nigeria’s inflation rate is at an all-time high of 21.47%, having risen steadily for ten months. Purchasing power is also at an all-time low, with rising inflation rates eroding much of it. Carbon Zero, for example, makes it easier for people to purchase items with more affordable payment structures.

With this product, Carbon has joined America’s Affirm and PayPal, Australia’s Afterpay, Europe’s Klarna, and East Africa’s M-Kopa as a major BNPL player in Nigeria. According to Insider Intelligence, the number of BNPL users increased from 50.6 million in 2021 to 79 million in 2022, with the figure expected to rise to 88.2 million in 2023 and 104.6 million in 2026. According to Global Data, the market was worth $141.8 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 33.3% through 2026, when it will be worth $596.7 billion.

While these are global estimates and, in many ways, optimistic projections, they paint a picture of what could be and the numerous opportunities that await.

“BNPL is an important and growing component of the payments industry,” says Zeeshan Anwar, a corporate and retail banking expert in the UK. It provides compelling benefits to customers by increasing payment options for low-income customers and saving money by reducing the need to pay excessive credit fees. If delivered correctly, the BNPL proposition has significant value and an ethical contribution.”

Nigeria is one of the low-income countries mentioned by Anwar. It is, however, undergoing a digital financial revolution that is still in its early stages. It would have been unthinkable ten years ago for the average Nigerian to be able to obtain a loan or pay in installments for a product they desperately desired. But that is no longer the case. A lot has changed, but there is still work to be done, and Carbon wants to be on the cutting edge of what could be.