In the face of skyrocketing inflation rates, a recent study conducted by SBM Intelligence has unveiled a significant shift in the financial habits of Nigerians. The study discloses that a staggering 27% of Nigerians, spanning various income groups, rely on loan apps to manage their expenses.

The Loan App Surge

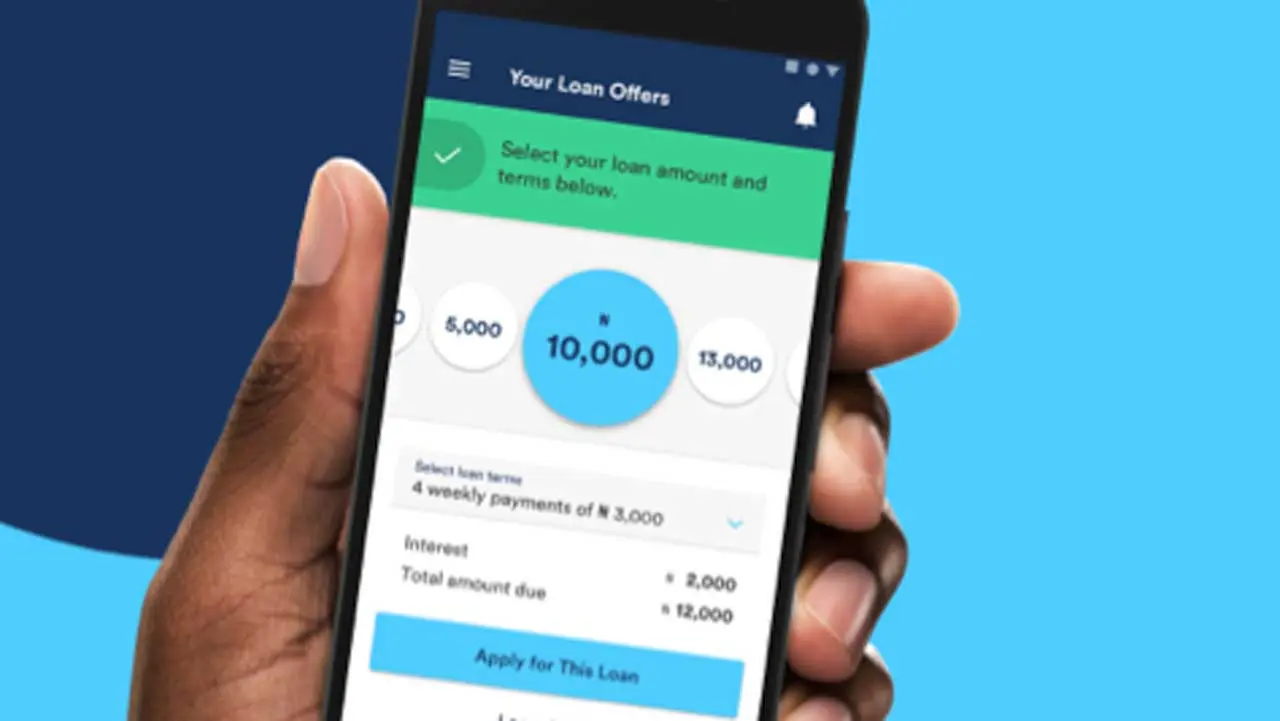

Nigeria’s rise in loan app usage is closely tied to the alarming inflation levels. Online banks have quickly offered credit facilities, primarily targeting those in the low-income bracket. Notably, approximately 161 loan apps have received full approval from Nigerian regulatory authorities to operate. Despite concerns about unethical practices, Nigerians’ demand for credit facilities from these digital lenders continues to surge.

Coping with Escalating Food Costs

While the study primarily focuses on assessing how Nigerians across different income categories allocate their spending on food, it also sheds light on their adaptability to the rising cost of living.

- For those earning the minimum wage of N30,000 and below, a staggering 49% are allocating their entire income towards food.

- The study further highlights that 47% of individuals earning between N31,000 and N50,000 also channel their entire income into food expenses.

- Even among those earning between N51,000 and N80,000, more than 60% of their income is on food expenses.

Food Inflation Challenges

Nigeria has been struggling with relentless inflation, primarily from soaring food prices. The latest data from the National Bureau of Statistics reveals that Nigeria’s inflation rate currently stands at 26.72%, with food inflation at a staggering 30.64%. This persistent surge in inflation marks the ninth consecutive month of rising inflation and the highest rate in almost two decades. The recent removal of fuel subsidies and the turbulence in the foreign exchange market have exacerbated the situation.

In response to this crisis, the Federal government has declared a state of emergency on food security within the country. To alleviate the hardships faced by Nigerians during these trying times, they have also approved a N35,000 wage award for six months.

As Nigerians grapple with the economic challenges of rising food prices and inflation, the increasing reliance on loan apps underscores the urgent need for sustainable economic solutions. With a focus on addressing the root causes of food inflation and exploring long-term economic stability, Nigeria faces a pivotal juncture in its economic trajectory.