While investors believe that the ruling-party candidate Bola Tinubu, who has gained an early lead in the nation’s presidential election results, will deliver changes to lift Africa’s largest economy out of a fiscal catastrophe, Nigerian bonds are registering some of the strongest gains in emerging markets.

In a Bloomberg index of 71 emerging and frontier countries, five of the West African country’s dollar-denominated bonds were among the top 10 performances on Monday.

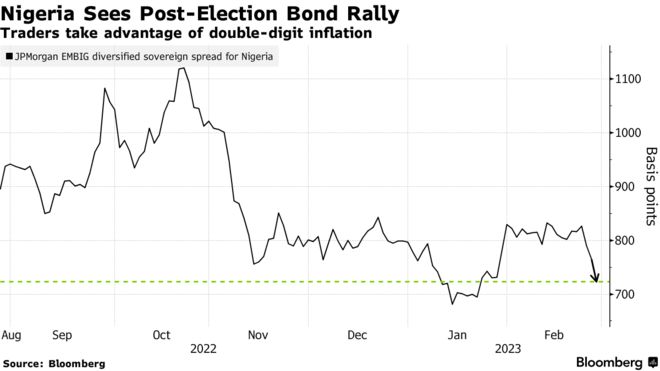

Monday was the biggest reduction in the nation’s sovereign risk premium this year, according data from JPMorgan Chase & Co. Lagos’ equities benchmark reached an eight-month high.

After the presidential election on February 25, the results are still being counted, but early indications favor Tinubu in three crucial states. Investors anticipate that the country’s new leader will make the tough choices necessary to increase tax income, stable the currency, and reduce debt.

“Markets seem to be increasingly pricing in a Tinubu win, given the expectations that he could push through reforms quicker than others,” said Simon Quijano-Evans, the chief economist at Gemcorp Capital Management in London. “But it is difficult to see this holding if the election winner is unable to quickly turn around the macro story with visible reforms and personnel changes.”

According to him, bargain hunters may have contributed to some of the gains when Nigeria’s bonds declined in the months before the elections.

The yield on Nigeria’s bond due in 2047 decreased by 33 basis points to 11.5%, rising 1.8 cents on the dollar to reach 68.8. Securities with maturities in 2029, 2030, 2032, and 2033 all experienced price increases of above 2%. Stanbic IBTC Holdings Plc is responsible for more than half of the advances in the NGX 50 Index, which increased for a fourth straight day to reach its highest level since June 2022.

In the meantime, a JPMorgan measure of sovereign-risk premium decreased 42 basis points to 723. That represents a decrease of 104 basis points just in the last three days.

Up until Nov. 3, the indicator has consistently risen above the 1,000 basis-point threshold, which is regarded as the cutoff point for a country’s debt problems.

Even after Tinubu of the All Progressives Congress won the states of Ekiti, Ondo, and Kwara, the outcome remained uncertain. Peter Obi of the Labour Party received the most votes in Lagos state, while Atiku Abubakar of the main opposition Peoples Democratic Party narrowly won a majority in Osun.

“Tinubu, who we perceive as being the least market-friendly of the three main candidates, is currently in the driver’s seat, but it is still early days and the positive reaction in Nigerian credit could indicate that markets think Obi stands a fighting chance,” said Patrick Curran, a senior economist at Tellimer Ltd. “There is likely to be a positive macro policy shift at the margin no matter who wins the election.”

Nigeria’s entire debt stock increased by more than six times under outgoing President Muhammadu Buhari, reaching roughly 44 trillion naira.

According to the World Bank, the next president should swiftly carry out the reforms that Buhari failed to do, such as ending the multiple exchange-rate system that is discouraging investors, removing import restrictions, and eliminating fuel subsidies that consume the majority of the country’s profits from pumping crude.

“Default is a risk,” Charlie Robertson, the global chief economist at Renaissance Capital in London, wrote in a note. “By Wednesday, attention should turn to the challenges for the next administration. And they remain very challenging, unless oil provides some stunning upside surprises for a few years. The interest bill as a percent of federal revenues is very high.”