Rwanda tourism industry is bidding for a strong recovery in 2022 as it seeks to overcome the damage wrought by Covid-19.

With lucrative sponsorship deals in place with Champions League football clubs, plans to become a major air travel hub for East Africa and ambitions to host global sports tournaments, Rwanda is plotting an ambitious tourism recovery from the damage wrought by Covid-19.

But as it vies to establish itself as a tourist destination of global renown, Rwanda faces its stiffest competition not from its East African neighbours, but from Southern Africa, say analysts. Following the horrors of the genocide in 1994, which paralysed the country’s tourism sector for over a decade, Rwanda has had to build from a position of relative insecurity and consumer anxiety, placing the sector at a disadvantage in its efforts to draw tourists away from established destinations such as South Africa, Botswana and Namibia.

Regional cooperation

Its leading role in the development of the East Africa Tourism Platform (EATP), established in 2012, has demonstrated that Kigali views neighbouring markets in Kenya and Uganda not as competitors, but as assets which can draw international visitors to the “Land of a Thousand Hills”. The EATP promotes travel to and within the member states of the East African Community (EAC), facilitating the emergence of an East African tourist circuit which projects an image of regional stability while creating common industry standards.

The importance of regional cooperation was starkly demonstrated during the Covid-19 pandemic. Intra-regional, cross-border tourism threw a lifeline to Rwanda’s hospitality industry at a time when mass shutdowns in international source markets starved the sector of its customary demand. While this provided only a small cushion – the EATP reported revenues falling by an estimated 92% between 2019 and 2021 – a consistent trickle of income was nevertheless provided by East Africans travelling locally.

These efforts are also “all about regional marketing”, Nigel Vere Nicoll, president and managing director of the African Travel and Tourism Association, tells African Business.

“The market they’re fighting is the Southern African market… East Africans are banding together more and more now – Kenya, Uganda, Rwanda particularly and to some extent Ethiopia.”

Rwanda’s sports strategy

Rwanda has been particularly aggressive in marketing itself as a global tourist destination – tourism agency Visit Rwanda has a $12m-a-year shirt sponsorship agreement with the English Premier League’s Arsenal and a similar deal worth up to $10m-a-year with French Ligue 1 club Paris Saint Germain. In May, Rwanda hosted first-team players Julian Draxler, Thilo Kehrer, Keylor Navas and Sergio Ramos for a three-day promotional visit.

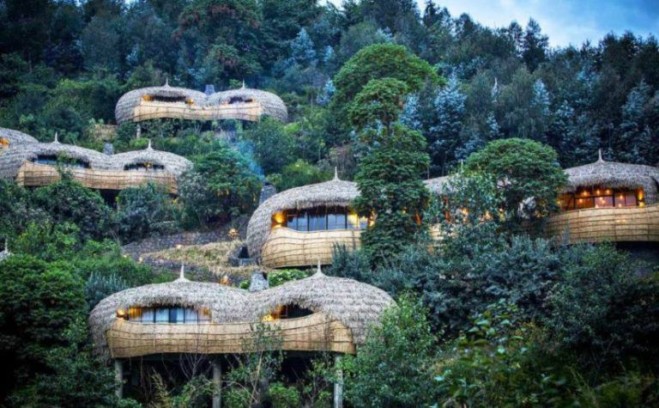

The country’s natural attractions are a key part of the marketing strategy – during their tour, the stars safaried in Akagera National Park and visited the famous mountain gorillas at the Volcanoes National Park.

Rwanda’s sports strategy goes beyond sponsorship deals – Kigali hosts the NBA’s annual Basketball Africa League, the first contest held by the basketball superpower outside the USA, and the country has pitched itself as a major destination for cycling, volleyball and other sports.

Sports promotion and hosting is just one aspect of the country’s outreach strategy. The country is also expected to work with the EAC on removing regulatory barriers to tourism. Nicoll, whose organisation has 630 members across 21 African countries, forecasts that “Schengen-type policies” modelled on European freedom of movement will unlock further opportunities for a sector which already contributes an average of 8.1% to the GDP of EAC economies, generating 17.2% of export earnings and sustaining a combined 3.26m direct and indirect jobs according to an October 2020 report from the EATP.

EAC visa provisions allow East Africans to cross borders between member states free of charge, with just a national identity card. Meanwhile, international tourists visiting the region are able to apply for a single document, the East African Tourist Visa, which allows them to move unrestricted between Rwanda, Uganda and Kenya for 90 days at a cost of only $100.

The knock-on effects of Covid lockdowns in tourist source markets demonstrated that “stretching these alliances and encouraging cross-border and domestic tourism is extremely important. That was what they survived on”, says Nicoll.

Can Kigali become an air transport hub?

Amid competition from Addis Ababa and Nairobi, Kigali hopes to become a major air travel hub in East Africa. Furthermore, it is hoped that a lucrative deal with Qatar Airways may help to establish Rwanda as a standalone destination for international tourists and insulate it from the knock-on effects of future regional instability.

Speaking to African Business in March, RwandAir CEO Yvonne Manzi Makolo outlined plans to turn Kigali into a major transit hub following the expansion of Bugesera International Airport. With work set to be completed in 2024-25, the enlarged Bugesera will enable 7m passengers to travel through Rwanda every year. A September 2021 agreement which saw Qatar Airways purchase a 49% stake in RwandAir and a 60% stake in the airport will be mutually beneficial.

Code-sharing has “linked Kigali’s air transport hub with that of Doha, which allows us to expand our network significantly”, says Makolo. “We can now reach most of Eurasia, while Qatar can reach most of Africa.”

Rwanda’s air travel sector has rebounded strongly from the pandemic, with passenger numbers on course to return to pre-Covid levels this year. While plans to build upon the 29 routes offered in 2019 were shelved, the shutdown offered a chance to review existing strategies. RwandAir stopped operating less profitable routes to Senegal, Juba and Tel Aviv, replacing these with new destinations including Bangui (CAR), Goma and Lubumbashi (DRC).

Competing with other regional hubs in Addis Ababa and Nairobi, though, will be challenging. “I don’t know about them becoming a hub”, says Nicoll. “I’m not sure they really want to be a hub when they’ve got two big hubs either side of them.”

Kenya’s slow recovery and lack of a concerted meetings, incentives, conferences & exhibitions (MICE) strategy may strengthen Kigali’s case. The $300m, state-of-the-art Kigali Convention Centre, opened in 2016, has no equally modern parallel in Nairobi.

“Nairobi, which has more hotels than practically anywhere else in East Africa, has suffered really badly and Kigali has moved into that market very well in the sense that they were the first to go ahead with the convention centre there,” says Nicoll.

Industry hopes for peaceful Kenyan election

But even when Rwanda has the edge on its near neighbours, the success of its tourism strategy could be dictated by political events there. Kenya’s upcoming presidential election on 9 August, tightly contested by Raila Odinga and William Ruto, comes at an inopportune time for East Africa’s recovering tourism industry. Electoral controversy and concerns over potential violence have traditionally had a negative impact on tourism, not just in Kenya but across the East African region, which is reliant upon Nairobi as its main air transport hub for international tourists.