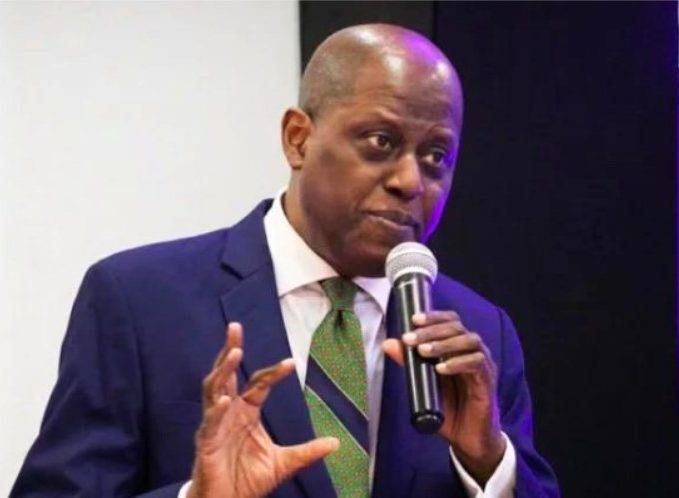

Mr. Olayemi Cardoso, Governor of the Central Bank of Nigeria (CBN), announced that Nigeria’s external reserves have surged to $36.89 billion as of July 16, 2024. Cardoso made this statement during a session on Friday with the Senate Committee on Banking, Insurance, and Other Financial Institutions in Abuja.

Cardoso highlighted that the CBN’s monetary policies have contributed to economic growth and stability. He noted that the reserves are sufficient to cover over 11 months of imports for goods and services or 14 months for goods alone. This exceeds the international benchmark of 3.0 months, providing a robust buffer against external economic shocks.

The Governor also praised Nigeria’s banking sector’s strength and diversity, including 26 commercial banks, six merchant banks, and four non-interest banks. He reported a significant reduction in the spread between official and Bureau De Change (BDC) rates, from N162.62 in January to N47.22 in June. This indicates improved market efficiency and reduced arbitrage opportunities.

Cardoso explained that the reserve rise, from $33.22 billion at the end of 2023 to $36.89 billion by mid-July, was primarily driven by receipts from crude oil-related taxes and other third-party payments. The first quarter of 2024 also saw a current account surplus and a better trade balance.

The Governor reassured the committee that the CBN remains vigilant and committed to supporting sustainable growth and economic stability despite positive trends. The CBN has implemented several measures to tackle inflation, including raising the policy rate by 750 basis points to 26.25 percent, increasing cash reserve ratios, and adopting inflation targeting as part of its new monetary policy framework.

In banking supervision, Cardoso reported decisive actions to ensure the banking sector’s stability. These included intervening in three banks, revoking Heritage Bank’s license, increasing minimum capital requirements, and enhancing anti-money laundering and counter-terrorism financing (AML/CFT) measures.

The CBN plans to recapitalize deposit money banks to improve capital adequacy and boost economic growth. The ultimate aim is to create a more stable, resilient, and efficient financial system that aligns with international best practices.

Clarification on Reserve Figures

Although Cardoso reported that the reserves had reached $36.89 billion, recent checks on the CBN’s external foreign reserve portal indicate that as of July 16, the reserves were $35.77 billion, rising to $35.93 billion on July 17, 2024. ENTREPRENEURNG has previously reported that Nigeria’s foreign reserves surpassed $35 billion for the first time under President Bola Tinubu’s administration.