About 10 leading companies in cement manufacturing, Fast-Moving Consumer Goods (FMCG), among other sectors recorded 28 per cent increase in cost of production, backed by hike in inflation rate and weaken, THISDAY findings has revealed.

The 10 companies in nine months of 2022 reported N2.32 trillion cost of production, representing an increase of 28 per cent from N1.82trillion reported in nine months of 2021.

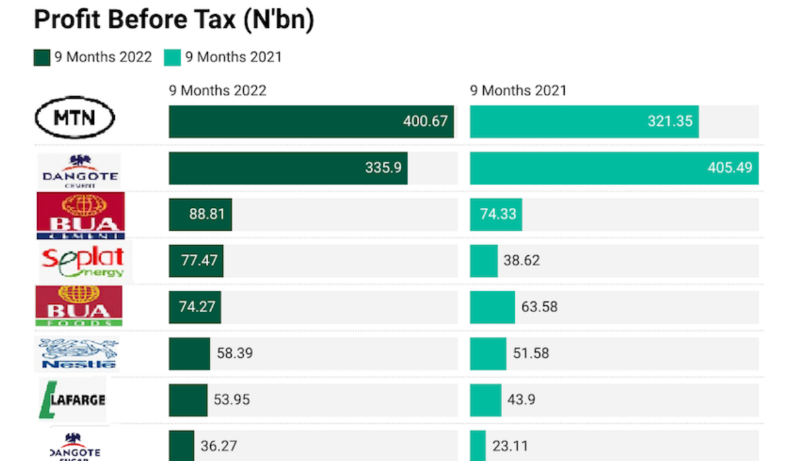

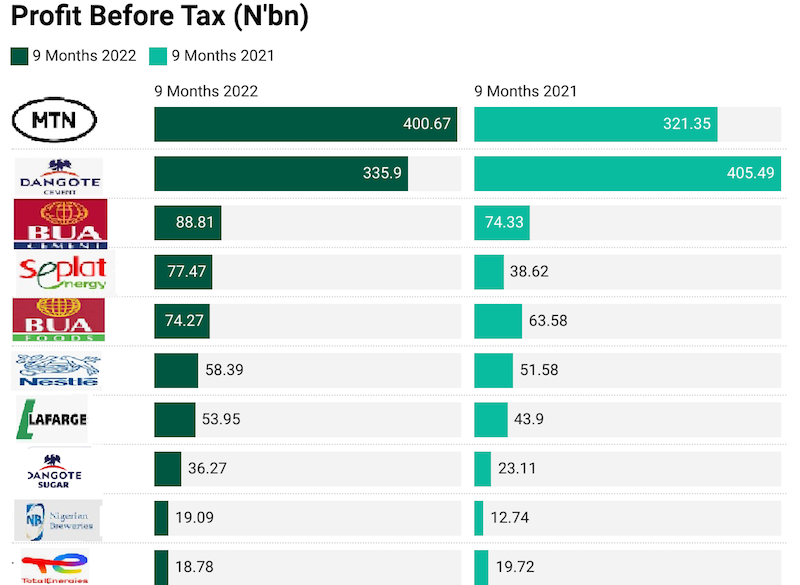

Despite increase in production cost, the 10 companies reported a total profit before tax of N1.16 trillion, an increase of 10.4 per cent over N1.05 trillion reported in nine months of 2021 with the likes of Dangote Cement Plc and Totalenergies Marketing Nigeria Plc reporting decline in profit before tax.

Nigeria’s inflation and local currency figures continue to hover at lofty levels as soaring consumer prices further shrank the incomes of households and businesses amid tough economic conditions.

According to the September Consumer Price Index (CPI) report by the National Bureau of Statistics (NBS), headline inflation surged to a fresh high of 20.77per cent in September 2022 from 15.6 per cent it was in January 2022.

Also, Naira at the Investors & Exporters Foreign (I & E FX) depreciated by N18.88/ Dollar to N432.37/ Dollar from N413.49/Dollar it commenced 2022 trading activities.

Besides, the average retail price of Automotive Gas Oil (diesel), according to NBS in September 2022 was N789.90 per litre, an increase of 210.20per cent from N254.64 per litre recorded in the corresponding month of the previous year.

Analysts are of the view that the rising inflation is driven by unrest between Russia/Ukraine, maintaining that the Central Bank of Nigeria (CBN) is tighten market liquidity to tackle inflation rate.

The Vice President, Highcap Securities Limited, Mr. David Adnori, said the reported hike in operating cost by Dangote Cement, Lafarge Africa, among others is a reflection of upward movement in the interest rate environment and weaken foreign exchange.

According to him, “Inflation at 20.77per cent as of September 2022 and scarcity of foreign exchange are expected to impact on cost of production of these companies at which they are sensitive to inflation rate movements.”

He added that the impact might erode these companies’ profit in 2022 full financial year and dividend payout to shareholders.

The CEO, Centre for Promotion of Private Enterprise (CPPE), Dr Muda Yusuf said inflationary pressures remain a key concern in the Nigerian economy, both for businesses and the citizens.

He explained that high inflation rate would lead to an escalation of production and operating costs for businesses and erosion of profit margins.

He added that hike in inflation rate has weak manufacturing capacity utilization, high food prices which impacts adversely on citizens welfare and aggravates poverty.

He explained that the major drivers of inflation and cost in the economy include exchange rate depreciation, which has a significant impact on headline inflation, “especially the core sub index and liquidity challenges in the foreign exchange market impacting adversely on manufacturing output.”

To tame the current inflationary pressure, he urged the government to reform the foreign exchange market to stabilize the exchange rate and reduce volatility and address foreign exchange liquidity issues through appropriate policy measures.

THISDAY gathered that BUA Cement Plc, BUA Foods Plc, Nestle Nigeria Plc, MTN Nigeria Plc, Dangote Sugar Plc and Totalenergies Marketing Nigeria Plc report production cost above inflation rate in the period under view.

BUA Cement reported 43.3 per cent increase in production cost to N142.8billion nine months of 2022 from N99.65billion in nine months of 2021, driven by 60 per cent increase in energy cost and 43.07 per cent increase in materials cost.

For BUA Foods, its production costs grew by 23.2 per cent to N195.64billion in nine months of 2022 from N158.83billion in nine months of 2021.

The Managing Director, BUA Foods, Ayodele Abioye in a statement said, “We continue to navigate the high input cost environment to deliver double digit growth within the period.”

The company in its outlook said, “Recent environmental disruptions such as flooding impacting on logistics efficiencies, energy cost, rising input cost, coupled with rising FX concerns and tightening stance of the CBN which further interest rate by another 100basis points to 15.5per cent are all core mitigating areas for us. We expect optimizing our supply value chain as we strive to increase market share across market regions.”

Further findings revealed Dangote Sugar reported the highest percentage in cost of production to N230.88billion in nine months of 2022 from N158.75billion in nine months of 2021, representing an increase of 45.44 per cent.

For Dangote Cement, it reported about N483.83billion cost of production from N403.4billion in nine months of 2021 that contributed to 17.2 per cent decline in profit before tax to N335.9billion in nine months of 2022 from N405.5billion in nine months of 2021.

Fuel & power consumed accounted for 41 per cent of the cement manufacturing company production cost in nine months of 2022 from 35.14 per cent in nine months of 2021.

The company also reported N144.9billion material consumed in nine months of 2022, representing an increase of eight per cent from N134.17billion reported in nine months of 2021.

SOURCE: THISDAY