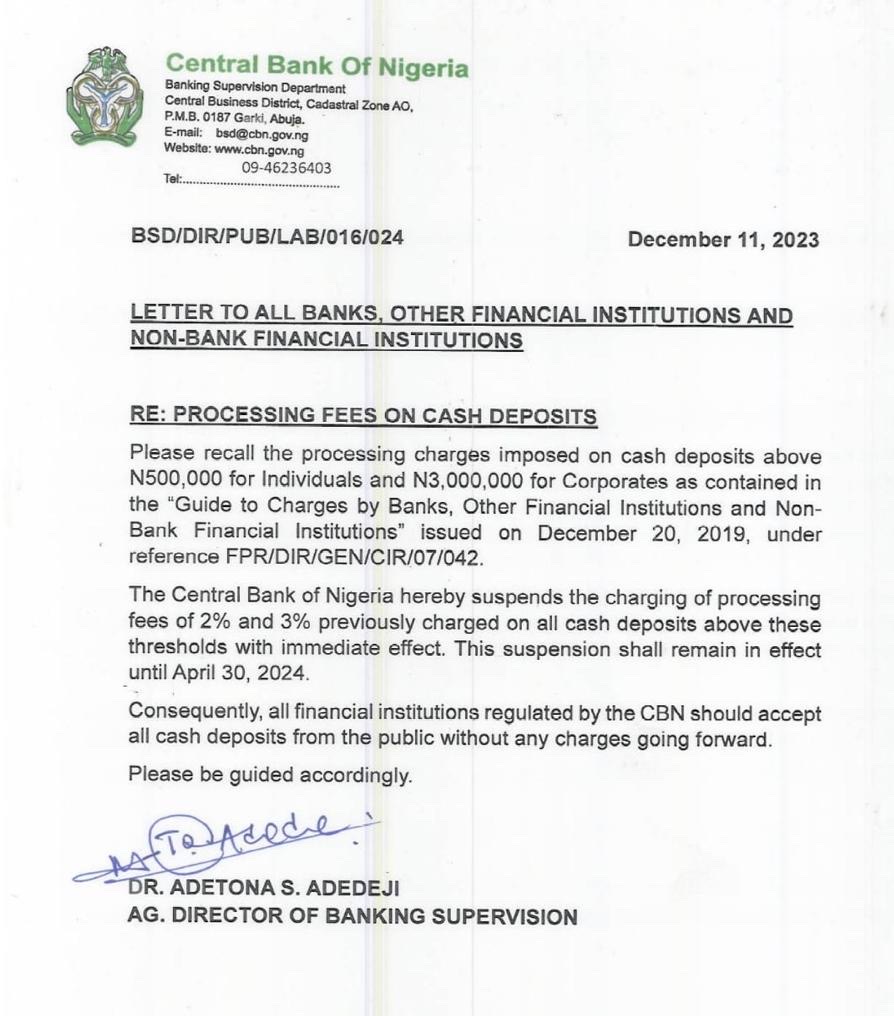

In a noteworthy policy shift, the Central Bank of Nigeria (CBN) has issued a directive suspending processing charges on substantial cash deposits in individual and corporate accounts. Effective immediately and extending until the end of April 2024, this decision eliminates the 2% and 3% processing fees previously applied to deposits exceeding N500,000 for individual accounts and N3,000,000 for corporate accounts.

The directive, outlined in the “Guide to Charges by Banks, Other Financial Institutions, and Non-Bank Financial Institutions” from December 20, 2019 (FPR/DIR/GEN/CIR/07/042), applies to all banks, financial institutions, and non-bank financial institutions under CBN regulation. This move is perceived as a response to the evolving financial landscape and the evolving needs of depositors in Nigeria.

The CBN’s directive aims to encourage more substantial cash deposits, bolster liquidity, and potentially have positive effects on various sectors, including both small and large businesses.

Background and Evolution of Policy

This announcement follows the 2019 revelation by the CBN regarding transaction fees on cash deposits and withdrawals. The initial policy, introduced on September 19, 2019, imposed a 3% processing fee on withdrawals and a 2% processing fee on lodgments exceeding N500,000 for individual accounts. Corporate accounts faced higher fees, with 5% for withdrawals and 3% for lodgments exceeding N3,000,000.

In line with efforts to reduce cash in circulation, the CBN, a year ago, introduced revised cash withdrawal limits, restricting individuals and corporate entities to N100,000 and N500,000 per week, respectively. Cash withdrawals exceeding these limits would incur processing fees of 5% and 10%, respectively.

However, this recent directive supersedes the previous policies, putting a hold on processing fees for large cash deposits until April 2024. The move signifies a reevaluation of financial policies to adapt to the changing economic landscape, promoting liquidity and financial flexibility for depositors in Nigeria.

As the financial sector witnesses these adjustments, businesses, both small and large, stand to benefit from increased liquidity, fostering a more conducive economic environment.