The Central Bank of Nigeria (CBN) has announced that it will continue enforcing the cybercrime levy at 0.005% on all electronic transactions, as outlined in the newly released guidelines for the 2024-2025 fiscal year. This levy, which has been the subject of debate, is mandated by the Cybercrime (Prohibition, Prevention, etc.) Act of 2015 and aims to strengthen Nigeria’s cybersecurity infrastructure.

The levy percentage has been reduced from 0.5% announced in May 2024 to 0.005%. Per the guidelines, banks and other financial institutions must deduct the levy from all electronic transactions. The revenue will go towards a cybersecurity fund to protect Nigeria’s banking system from cyber threats.

The CBN stated: “The CBN shall continue to enforce the payment of the mandatory levy of 0.005 per cent on all electronic transactions by banks and other financial institutions, by the Cybercrime (Prohibition, Prevention, etc.) Act, 2015.”

Keystone Bank’s New Board of Directors

In a related development, the CBN has reconstituted the board of directors at Keystone Bank. Lady Ada Chukwudozie has been appointed as the new board chairman, along with five other non-executive directors: Abdul-Rahman Esene, Mrs. Fola Akande, Akintola Olusoji, Obijiaku Samuel, and Senator Farouk Bello. Two new executive directors, Ladi Oluwole and Abubakar Bello, have also been named.

Chukwudozie, a well-known figure in Nigeria’s corporate sector, brings nearly 30 years of experience in business strategy and management. Her career spans multiple industries, including De-Endy Industrial Company Limited, Dozzy Group, and the Manufacturers Association of Nigeria.

Abdul-Rahman Esene, with over 43 years of experience in banking and corporate finance, has held key roles in institutions like Fidelity Bank and Afrinvest.

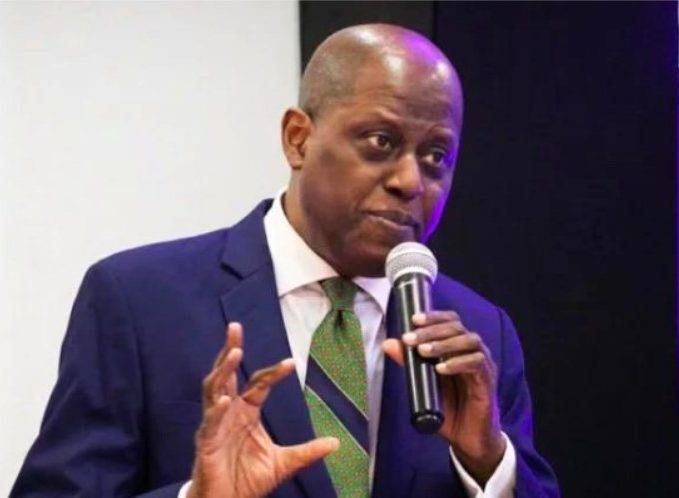

Keystone Bank’s CEO, Hassan Imam, expressed confidence in the new board members, highlighting their expertise and expected contributions to the bank’s growth and repositioning efforts.