The Monetary Policy Committee (MPC) of the CBN has announced a significant increase in the benchmark interest rate by 200 basis points, from 22.75% to 24.75%. This decision was made during the 294th MPC meeting held in Abuja, as revealed by the CBN’s governor, who also chairs the MPC.

Additionally, the apex bank has opted to maintain the Cash Reserve Ratio (CRR) at 45%, which is consistent with its previous decision. However, the CRR for merchant banks has been adjusted, raised from 10% to 14%. The liquidity ratio remains unchanged at 30%.

The current Monetary Policy Rate (MPR) of 24.75% reflects a notably high level, underscoring the CBN’s firm commitment to addressing inflation and stabilizing the exchange rate. While the 200-basis points increase is substantial, it falls short of the significant 400 basis points hike implemented by the bank in February.

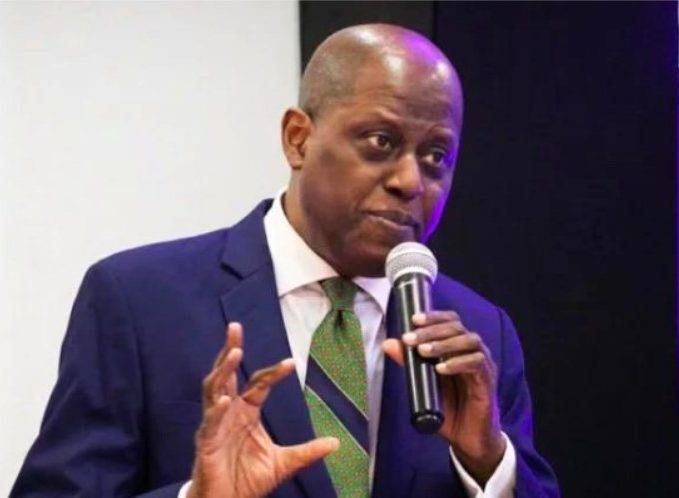

Yemi Cardoso, the CBN Governor, also commented on the impact of the decisions made during the February MPC meeting on the country’s economy, particularly on inflation and the exchange rate. Following the February meeting, there has been a noticeable appreciation and stabilization in the exchange rate between the US dollar and the naira. Although the exchange rate briefly peaked at N1800/$ in the parallel market, it has since stabilized around 1400/$.

However, inflation did not exhibit the same level of stability during this period. In February, Nigeria’s headline inflation surged to 31.7%, driven primarily by escalating food prices, reaching 35.92%. This represents an increase of 1.80% from the 29.90% inflation rate recorded before the February MPC meeting.

The next Monetary Policy Committee (MPC) meeting is scheduled for May 2024.