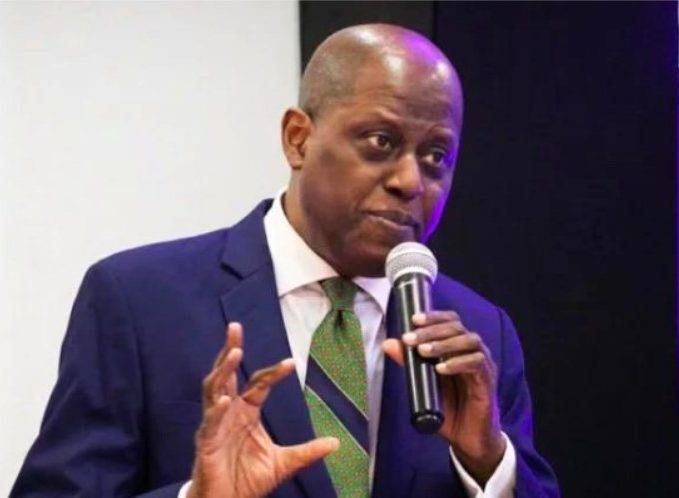

Yesterday, the Central Bank of Nigeria (CBN) increased its benchmark interest rate, known as the Monetary Policy Rate (MPR), by 400 basis points, raising it from 18.75 percent to 22.75 percent. Additionally, the CBN adjusted the Asymmetric Corridor around the MPR to +100/-700 from +100/-300. CBN Governor Mr. Olayemi Cardoso made these announcements during a press briefing following the Monetary Policy Committee (MPC) meeting in Abuja.

Cardoso also revealed that the MPC raised the Cash Reserve Ratio (CRR) of banks to 45 percent from 32 percent, while keeping the Liquidity Ratio unchanged at 30 percent. The decision to raise the MPR and CRR was motivated by the need to address high inflation rates and excess liquidity in the financial system.

CBN

Again, he emphasized that the committee’s decisions were driven by concerns about rising inflation levels and the need to manage inflation expectations. While acknowledging the trade-off between stimulating economic growth and controlling inflation, the committee believed that sustainable economic expansion can only occur in a stable economic environment. Therefore, the committee favored a significant increase in interest rates to effectively combat inflation.