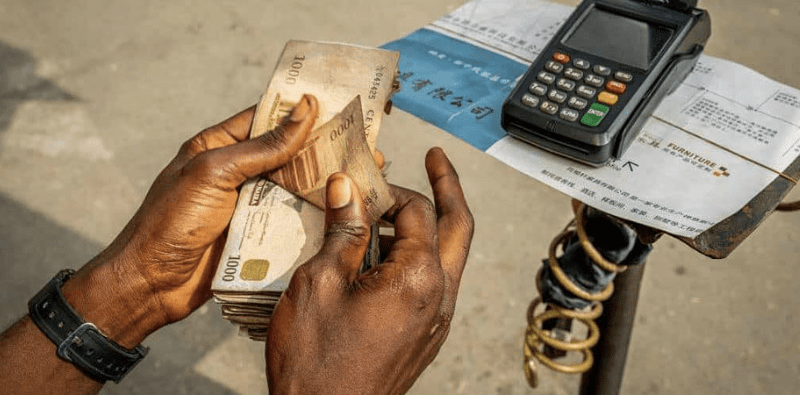

The Corporate Affairs Commission (CAC) has given Nigeria’s 1.9 million PoS agents a two-month deadline to register their agents and merchants with the commission. This initiative aims to enhance transparency and reduce fraud in the financial sector.

The announcement from CAC follows directives from the Central Bank of Nigeria (CBN) to fintech companies such as Moniepoint, OPay, and PalmPay to halt onboarding new members.

During a meeting with fintech companies in Abuja, the Registrar-General/Chief Executive Officer of CAC, Hussaini Magaji, SAN, emphasized the importance of this measure in safeguarding the businesses of fintech customers and strengthening the economy. He noted that the directive aligns with Section 863, Subsection 1 of the Companies and Allied Matters Act (CAMA) 2020, and the 2013 Central Bank of Nigeria’s guidelines on agent banking.

Tokoni Peter, the Special Adviser to President Bola Tinubu on ICT Development and Innovation, assured of the government’s commitment to facilitating a smooth process in line with the Renewed Hope Initiative of the present administration.

Representatives from various fintech companies attended the meeting, including Opay, Momba, Palm Pay, Moniepoint, and Paystack.