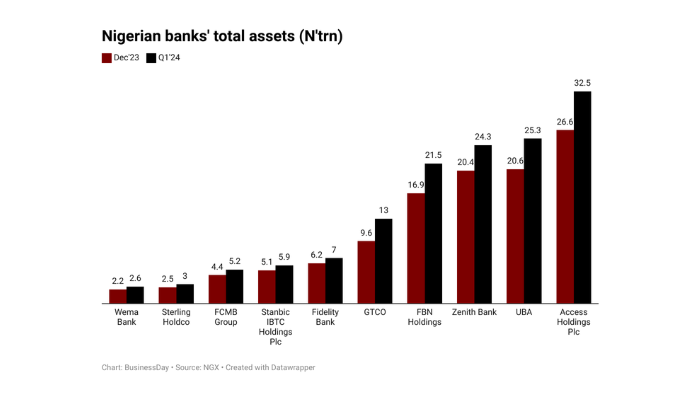

The total assets of 10 major Nigerian banks increased by 22.5 percent in the first quarter of 2024, according to data gathered by BusinessDay.

These banks include Zenith Bank Plc, United Bank for Africa (UBA) Plc, Access Holdings Plc, FBN Holdings Plc, FCMB Group Plc, Stanbic IBTC Holdings Plc, Guaranty Trust Holding Company (GTCO) Plc, Fidelity Bank Plc, Sterling Financial Holdings Company Plc, and Wema Bank Plc.

Their financial statements reveal that their combined assets escalated to N140.3 trillion in Q1, up from N114.5 trillion at the end of December 2023. However, Afrinvest Limited’s recent data indicates that the banks’ total assets represent merely 16.4 percent of Nigeria’s $0.5 trillion Gross Domestic Product (GDP), a figure significantly lower than that of banks in countries with comparable GDPs.

For context, the asset-to-GDP ratio for banks is 100 percent in Egypt, 74 percent in South Africa, and 47 percent in Kenya.

In Brazil, with an economy valued at $1.9 trillion, bank assets represent 125 percent of GDP. In Mexico, where the GDP stands at $1.5 trillion, this figure is 45 percent, and in the Netherlands, with a GDP of $1 trillion, it is 104.6 percent.

The relatively low asset base of Nigerian banks, compared to their peers, presents a strong argument for a recapitalisation exercise, as stated by Ike Chioke, the group managing director of Afrinvest West Africa Limited.

“We looked at all the commercial banks in Nigeria today and all the non-interest banks. We see that based on the CBN capital requirement, there’s a need for the Nigerian commercial banks to get to N3.7 trillion to bolster the N1.9 trillion they currently have,” he said.

“Clearly, we have quite a lot of work,” Chioke added.

Recent analysis of financial statements shows that Access Bank leads with total assets valued at N32.6 trillion as of March 2024, with UBA at N25.3 trillion and Zenith Bank at N24.3 trillion in assets.

In the same period, the liabilities of these banks increased by 22.7 percent, reaching N123.6 trillion, up from N103 trillion.

The total assets of a bank comprise all it possesses with economic value, crucial for its operations and for generating revenue.

When a bank’s total assets surpass its total liabilities, it results in a positive net equity or net worth.

Regarding asset growth rates, GTCO saw the most significant rise at 35.4 percent, followed by FBN Holdings at 27.2 percent, and UBA at 22.8 percent.

Access Holdings

Access Holdings’ total assets rose to N32 trillion in the first quarter of 2024, up 22.2 percent from N26.6 trillion as of December 2023.

The holding company’s total liabilities amounted to N30 trillion, a 23.5 percent increase from N24.5 trillion while its total shareholders’ fund rose to N2.4 trillion from N2.1 trillion.

GTCO

GTCO’s total assets stood at N13 trillion in the first three months of 2024, up 35.4 percent from N9.6 trillion as of December 2023.

The holding company recorded total liabilities which stood at N10.9 trillion from N8.2 trillion in the period reviewed.

Total equity amounted to N2 trillion from N1.5 trillion.

Zenith Bank

Zenith Bank’s total assets rose to N24.3 trillion in the first three months of 2024, a 19.1 percent increase from N20.4 trillion as of December 2023.

The bank’s total liabilities amounted to N21.4 trillion from N18 trillion.

Total shareholders’ equity amounted to N2.8 trillion in the period under review from N1.4 trillion.

FBN Holdings

FBN recorded N21.5 trillion as its total asset in the first three months of 2024 from N16.9 trillion reported as of December 2023.

Total liabilities amounted to N19.6 trillion from N15.1 trillion and total equity grew by 11.7 percent to N1.9 trillion from N1.7 trillion.

UBA

UBA’s total assets grew by 11.8 percent to N25.3 trillion in the first three months of 2024 from N20.6 trillion as of December 2023.

The bank’s total liabilities increased to N22.7 trillion from N18.6 trillion in the period reviewed. UBA’s total equity amounted to N2.6 trillion from N1.9 trillion.

Stanbic IBTC Holdings

Stanbic IBTC Holdings’ total assets stood at N5.9 trillion in Q1, up 15.7 percent from N5.1 trillion as of December 2023.

Total liabilities amounted to N5.4 trillion, up 17.4 percent increase from N4.6 trillion. The holding company recorded total equity of N544 billion, up 7.5 percent from N506 billion in the comparable periods.

Sterling Holdings

Sterling Holdings recorded N3 trillion as its total asset in the first three months of 2024, up 20 percent from N2.5 trillion as of December 2023.

Total liabilities amounted to N2.8 trillion from N2.3 trillion and total equity grew to N168 billion from N183 billion.

Wema Bank

Wema Bank’s total assets amounted to N2.6 trillion in Q1, up 18.2 percent from N2.2 trillion as of December 2023

The bank’s total liabilities grew by 14.3 percent to N2.4 trillion from N2.1 trillion. Equity attributable to equity holders of the bank stood at N148.9 billion from N139 billion in the period reviewed.

Fidelity Bank

Fidelity Bank’s total assets amounted to N7 trillion in Q1, a 12.9 percent increase from N6.2 trillion as of December 2023.

The bank’s total liabilities stood at N6.5 trillion, up 14 percent increase from N5.7 trillion. Similarly, the bank’s total equity grew to N467 billion from N437 billion during the reviewed period.

FCMB

First City Monument Bank’s total assets increased to N5.2 trillion in the first three months of the year, an 18.2 percent increase from N4.4 trillion as of December 2023.

The bank’s total liabilities stood at N4.7 trillion, up 20.5 percent increase from N3.9 trillion.

The bank’s total equity grew by 7.4 percent to N494 billion from N460 billion in the comparable period.