In a recent ruling, the Federal High Court in Lagos has dismissed a legal challenge against a provision in the Central Bank of Nigeria (CBN) Customer Due Diligence Regulations 2023.

The contentious provision, Section 6(a)(iv), mandates banks to gather and authenticate customers’ social media handles as part of their Know-Your-Customer (KYC) process.

The lawsuit was initiated by Chris Eke, a legal practitioner based in Lagos, contesting the regulation’s constitutionality, alleging it violates citizens’ privacy rights enshrined in Section 37 of the 1999 Constitution.

However, the CBN countered the challenge, urging the court to reject it for incompetence.

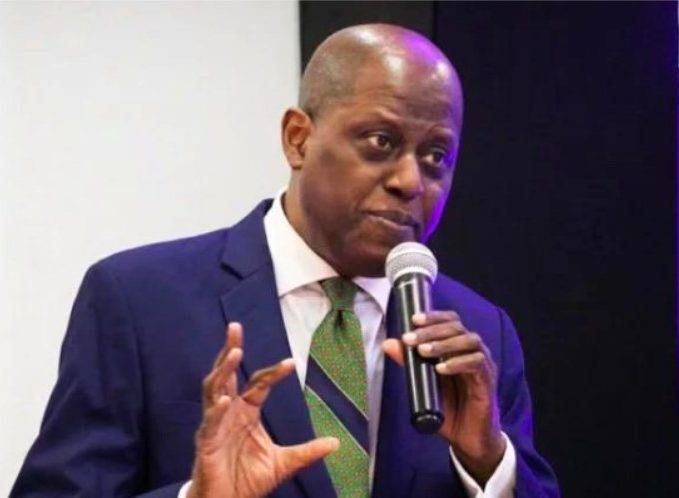

Justice Nnamdi Dimgba, in his verdict, delivered on Wednesday, dismissed the applicant’s claims, highlighting that the regulation primarily targets financial institutions, not private individuals like the applicant.

Furthermore, Justice Dimgba noted the absence of evidence showing any financial institution implementing the regulation, thus dispelling claims of disruptions or inconveniences to the general populace.

Regarding privacy concerns, Justice Dimgba equated the provision of social media handles to disclosing email addresses or phone numbers, emphasizing their similarity in facilitating communication between banks and customers.

Consequently, the judge dismissed the suit and upheld the preliminary objection raised by the CBN’s legal team.

This ruling underscores the judiciary’s interpretation that divulging social media handles to banks aligns with providing other contact information, warranting similar privacy protections under the law.

Notably, the CBN introduced the Customer Due Diligence Regulations 2023 to bolster its efforts against financial crimes. Under section 6 (IV) of the new regulations, financial institutions are mandated to collect and verify customers’ social media handles.