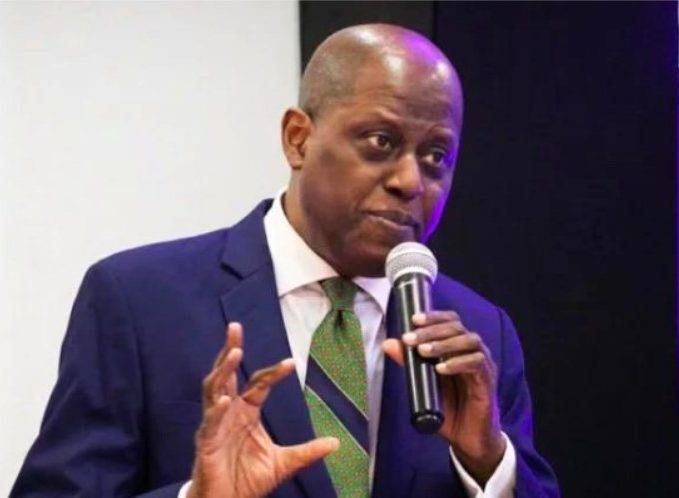

Dr. Muda Yusuf, the CEO of the Centre for Promotion of Private Enterprise (CPPE), has highlighted the adverse impact of instability in customs duty exchange rates on the business community. He emphasized that the erratic nature of customs duty rates is causing high volatility in cargo clearing costs, exacerbating inflationary pressures and increasing investment risks in the real sector of the economy.

Yusuf pointed out that during the first quarter of 2024, customs duty exchange rates changed 24 times, followed by 10 changes in April alone. He stressed that such frequent alterations harm production, planning, and other activities in Nigeria’s real sector.

He cited an example of the customs duty exchange rate, which surged to N1373.65/$ as of May 1, compared to less than N1200/$ just a few days prior. This rapid fluctuation makes it extremely challenging for investors to make informed decisions and plan effectively.

According to Yusuf, the current situation introduces unprecedented uncertainty and unpredictability in international trade dynamics, undermining investors’ confidence and hindering economic growth. He emphasized that managing volatility in the foreign exchange market is crucial for sustaining growth aspirations.

Yusuf urged the Central Bank of Nigeria (CBN) to establish a framework to minimise volatility in customs duty exchange rates. He proposed adopting a quarterly customs duty exchange rate, with an initial rate of N1000/$, following consultation with fiscal authorities. This approach aligns with the government’s commitment to enhancing investor confidence and promoting economic development through effective coordination between fiscal and monetary policies.