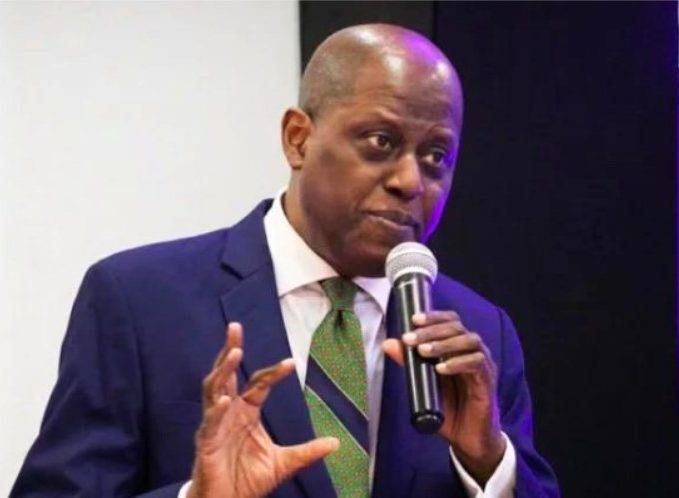

The Governor of the Central Bank of Nigeria, Dr Olayemi Cardoso, has said that conflict and natural disasters have put countries’ financial stability at risk.

Cardoso gave the warning in Abuja at the Joint World Bank/IMF/WAIFEM Regional Training on Medium Term Debt Management Strategy in Abuja on Monday.

Represented by the Director of the Monetary Policy Department of the CBN, Dr. Mohammed Tumala, the apex bank boss said that recent events like the COVID-19 pandemic, geopolitical conflicts, and natural disasters have put a strain on many countries’ finances, making them more likely to seek loans from diverse sources.

However, these non-traditional lenders might come with stricter repayment terms and potentially higher risks compared to Paris Club loans.

“Following the COVID-19 pandemic, along with other developments such as geopolitical conflicts and natural disasters, the financial strain on our sub-region has escalated, posing a threat to their macroeconomic and financial stability and prospects for faster recovery,” he said.

He went on to argue that the way countries manage debt owed to the Paris Club may not be as effective for this new set of lenders. Cardoso expressed concern that this new debt landscape could pose a threat to financial stability and economic recovery for many countries.

The CBN governor said, “Public debt dynamics are increasingly influenced by significant debt servicing obligations to non-Paris Club members and private lenders, including commercial banks and bond investors. This shift in the debt structure represents a critical evolution in the global financial framework, with profound ramifications for public debt management in our countries.”

Also, the West African Institute for Financial and Economic Management has warned that Nigeria is at a high risk of falling into debt distress and urged the federal government to look for ways of improving revenue generation

Director-General of the West African Institute for Financial and Economic Management, Dr. Baba Musa, told journalists: “When you compare Nigeria with the rest of the world or peer countries, you realize that with the 37 per cent debt to GDP ratio, we still have room to borrow but the issue with the Nigerian debt is you don’t use GDP to pay debts rather you use the revenue to pay for any debt.”

“If you look at it from the revenue side Nigeria is at a high risk of debt distress in terms of our borrowing so what we need to do now is to step up our capacity to generate revenue, the more revenue we have, the less ratio of debt to revenue we have.”

WAIFEM, Musa said, is “very much in support of what the federal government is doing because there is a window for the government to raise more revenue, all that the people need to do is to support the federal government diversify the sources of revenue and of course generate more sources of revenue, once we have this we don’t have debt problem but rather revenue problem

Musa said, “What the Medium Term Debt Strategy does is that it smoothens the debt service so that going forward when borrowing, you take into consideration the redemption profile that you have and the type of loans that you have in your existing portfolio and then it will enable you also to minimise the cost and risk the future loans will add to the debt portfolio.”

In May 2023, the International Monetary Fund said that Sub-Saharan Africa could stand to lose the most if the world were split into two isolated trading blocs centred around China or the United States and the European Union.

In this severe scenario, sub-Saharan African economies could experience a permanent decline of up to four per cent of real gross domestic product after 10 years according to our estimates—losses larger than what many countries experienced during the Global Financial Crisis.

SOURCE: PUNCHNG