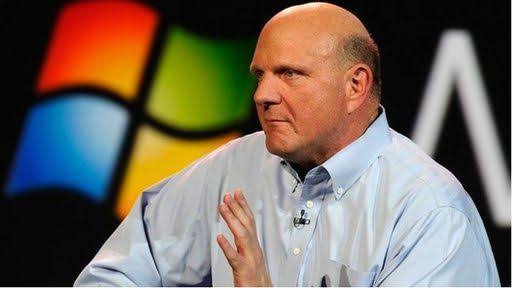

For the majority of people, passive income is a small amount of additional cash that may be earned with little effort to support a primary source of income. It’s $1 billion for Steve Ballmer.

That amount in dividends from Microsoft is due to Ballmer, the sixth richest person in the world, in 2024. The IT behemoth increased its quarterly dividend payout to 75 cents per share, or $3 per share yearly, prior to this.

Ballmer, the former CEO of Microsoft, would receive slightly under $1 billion in the fiscal year 2024 since, as of 2014 (the last time he submitted an ownership statement and it appears he has changed his Microsoft stock), he owned 333.2 million shares of the company, or 4% of the total. That covers the cost of just owning the stock, without regard to its performance.

Naturally, that assumes the board of directors at Microsoft does not vote to reduce dividends. However, that doesn’t seem possible. The sum has only increased since the corporation started giving dividends to shareholders in 2003.

Ballmer will undoubtedly be liable to the 20% dividend tax on individuals making a taxable income of $500,000 or more, as he reported $656 million in income to the Internal Revenue Service in 2018, according to ProPublica. This implies that the taxes he will pay on the Microsoft dividends he receives will be very nearly $200 million.

A Wall Street Journal analysis indicates that $6 billion in dividends are expected to be paid out to Warren Buffet’s Berkshire Hathaway this year. This is due to the fact that Berkshire Hathaway invests mostly in dividend-paying stocks. Chevron, Bank of America, Apple, Coca-Cola, Kraft Heinz, and American Express are among the companies on that list.