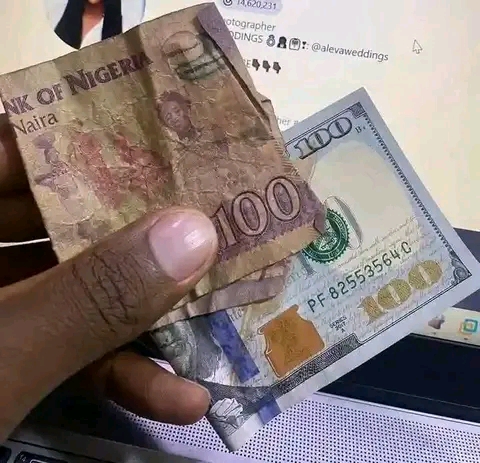

In a surprising turn of events, the Nigerian naira has reached a new all-time low, closing at N996.75 per dollar in the official Nigerian Autonomous Foreign Exchange Market (NAFEM). Concurrently, in the parallel market, the naira dropped to N1090 per dollar. This depreciation has caught many analysts off guard, given the recent efforts by the Central Bank of Nigeria (CBN) to clear its foreign exchange (FX) backlog, aimed at restoring confidence in the currency.

The domestic currency saw a significant decline of 12.24%, closing at N996.75 to a dollar at the end of business on Thursday, as reported by the NAFEM. This represents a loss of N122.04 or a 12.24% decrease compared to the N874.71 closing rate on Wednesday, marking a new record low according to the Nairametrics tracker. The last all-time low was recorded at N993.8 on October 30th.

The intraday high and low recorded were N1100/$1 and N744.00/$1, respectively, indicating a substantial spread of N356/$1. The forex turnover at the close of trading stood at $228.54 million, a 101.32% increase compared to the previous day.

In the parallel forex market, where currencies are traded unofficially, the naira’s exchange rate depreciated by 5.5%, quoted at N1090/$1, with peer-to-peer traders quoting around N1110.10/$1. There’s a notable convergence between the official and parallel market exchange rates, with a gap of approximately N100, nearing a 10% premium, which is generally deemed acceptable.

Financial experts, in light of the naira’s ongoing decline, have called on the CBN to implement measures to de-dollarize the economy. Dr. Biodun Adedipe, founder and chief consultant of B. Adedipe Associates Limited, suggests strategies such as preventing government agencies from charging local operators in US dollars and ensuring the sale of crude oil to local refineries is conducted in Naira rather than dollars.

Addressing the situation, Aminu Gwadabe, President of the Association of Bureau de Change Operators of Nigeria, warned speculators, emphasizing that the CBN’s actions were designed to discourage currency speculation and safeguard the naira’s stability. He highlighted the dual impact of dollar liquidity injection and naira mopping through interest rate hikes as part of the CBN’s strategy.